How To Use Dependent Care Fsa Funds

When you have a health or limited-purpose FSA the total amount is available on the first day. Use the money to care for your family.

1 Dependent Care Fsa Flexible Spending Account Presenter

You decide on the amount of money you want to contribute to the account each pay period.

How to use dependent care fsa funds. So if you contribute 5K to the dependent care FSA then only 1K can be considered against the credit. A Dependent Care Flexible Spending Account FSA lets you save on dependent care expenses using pre-tax dollars. You can use funds in your FSA to pay for certain medical and dental expenses for you your spouse if youre married and your dependents.

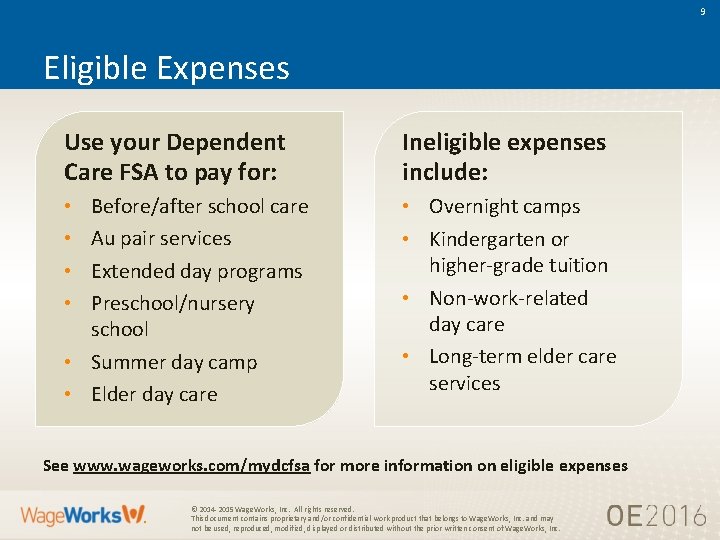

Under your employers dependent care plan you chose to have your employer set aside 5000 to cover your 2018 dependent care expenses. This includes preschool nursery school day care before and after school care and summer day camp. The Dependent Care FSA contribution limit was increased to 10500 and for a limited time unused funds can now be carried over into future years.

Claim all your money prior to March 15th of the next calendar year as any money left in the account after that date is forfeited. With dependent care FSAs you pay expenses out-of-pocket then receive reimbursement based on how much you have withheld from your paycheck for dependent care expenses. Your account is funded by payroll deductions before taxes.

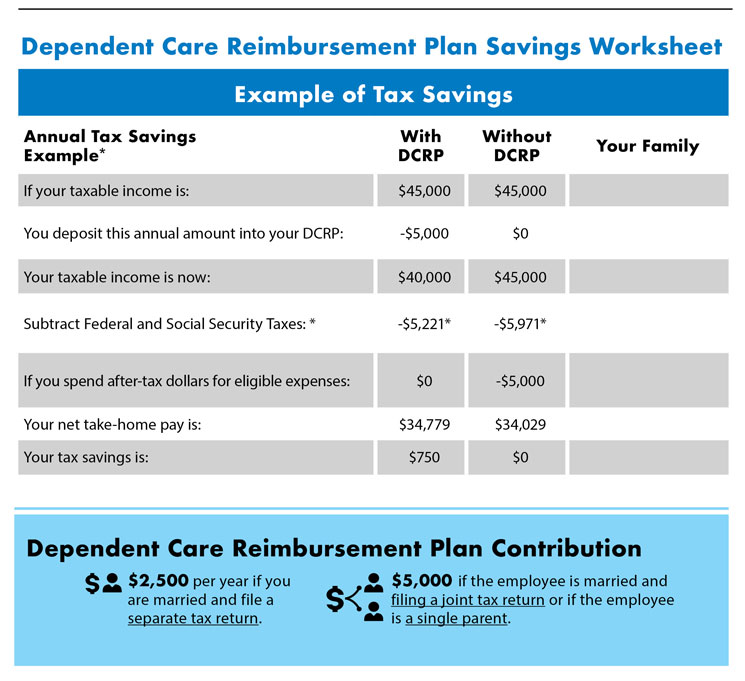

For 2021 employees can contribute up to 2750 to their health FSAs without incurring a penalty. Simply log in to your FSAFEDS online account at any time to manage all aspects of your Dependent Care FSA. The Internal Revenue Service allows families to set aside up to 5000 per year to pay for expenses like daycare or home health care for dependent children or elderlydisabled adults.

Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses. But this account is for eligible child and adult care expenses. Your employer may also contribute to your DCFSA.

In 2018 you incurred and were reimbursed for 4950 of qualified expenses. Those funds are then automatically withheld from your paycheck and deposited before taxes are deducted. If youre married your spouse can put up to 2750 in an FSA with their employer too.

Its the care your family needs while youre at. A debit or credit card. What is a Dependent Care Flexible Spending Account FSA.

A dependent care flexible spending account FSA can help you put aside dollars income tax-free for the care of children under 13 or for dependent adults who cant care for themselves. Look up eligible expenses. There are many situations that do not allow you to file claims such as an unemployed spouse providing child care or child care for a child over the age of 13.

Youll pay your dependent care costs directly and then apply for reimbursement. How a Dependent Care FSA Works. The 5000 is shown on your Form W-2 in box 10.

Dependent Care Flexible Savings Accounts FSA allow individuals to keep a portion of their tax-free earnings to pay for dependent care expenses. But there are an estimated 52 million dependent care accounts according to the financial research firm Aite Group and many of their holders have lost at least some income or have spouses who have. Money put into the account is pre-tax.

Your own money and then submitting receipts for reimbursement. Like other FSAs the dependent care FSA allows you to fund your account with pretax dollars. Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to pay for qualified dependent day care expenses to enable you to work.

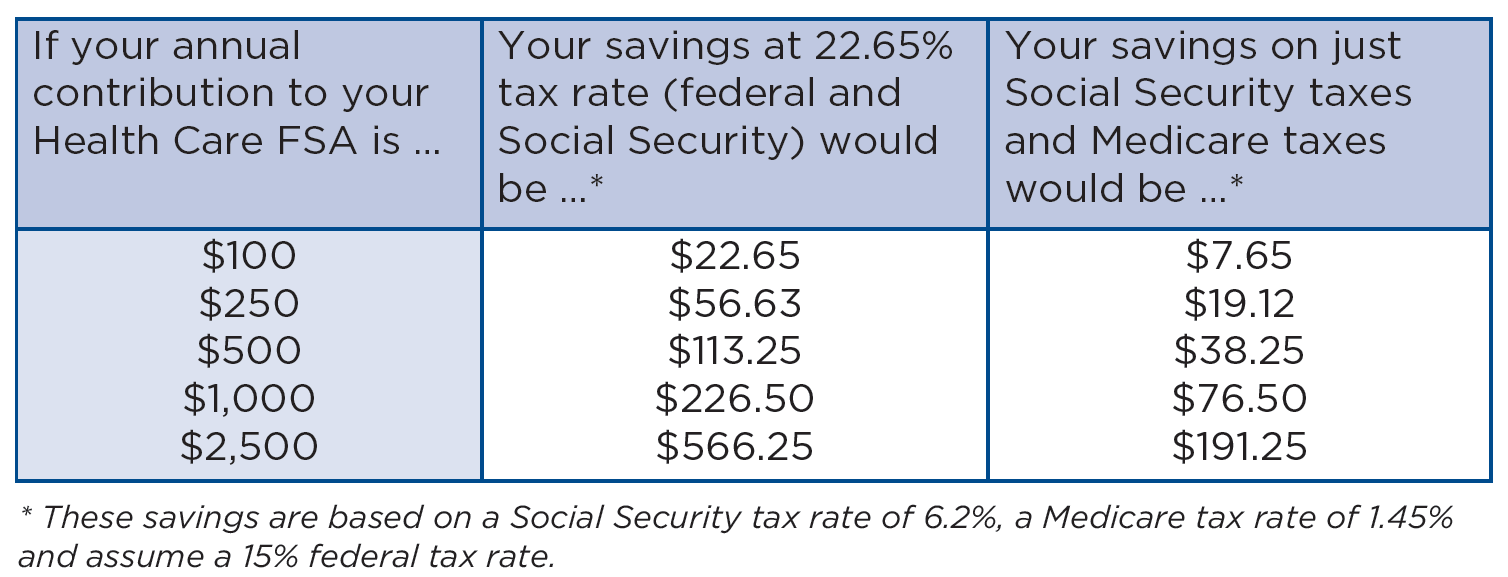

This means that the amount you allocate from each paycheck gets better tax treatment than the rest of your paycheck. Amounts spent by the employee are then reimbursed from their designated health FSAs or. Your child must be under the age of 13 for you to use a Dependent Care FSA for their care expenses.

Select your reimbursement methods by check or direct deposit Choose to. Dependent care FSAs are set up through your employer. This type of plan is a voluntary agreement to reduce your salary in return for an employer-provided fringe benefit.

FSAs including dependent care FSAs come with a tax advantage. For example if your employer put in 300 and you decided to contribute 600 you have 900 to spend right away. These workplace accounts more commonly known as dependent care flex spending account or flexible spending arrangement FSA are supposed to be a way for parents to deduct a portion of their.

Since FSA contributions are pre-tax you save money by. These expenses need to be work-related meaning you and your spouse must be working looking for work or attending school full-time. Understand the rules of the day care account fully.

Are the tuition payments eligible for reimbursement under my Dependent Care FSA. Submit claims and view claims status. You can spend your dependent care savings account funds on a wide range of care for eligible members of your family.

When you choose to participate in a dependent care assistance program through your employer your employer has to report that value in box 10 of your Form W-2. Using Dependent Care FSA to pay a relative for babysitting Jul 27 2017 Youll need to check with your employers benefits administrator about how specifically to get the money out of the DCFSA account but its usually pretty easy - just a form you submit which will likely require your mothers address and social security number along with receipts or some other evidence of what you actually. The loss of tucked-away funds is a prospect some moms and dads face this year if they contributed to the federal Dependent Care Assistance Program or DCAP.

That money may help pay for a variety of eligible services including day care nursery school preschool after-school or senior day care. So on the surface this seems like they cover similar areas. You can spend FSA funds to pay deductibles and copayments but not for.

In addition you can use your dependent care FSA to pay for mileage to and from covered care if the mileage is incurred by a care provider for example a nanny driving your child to preschool is. The usage of the Dependent Care FSA decreases the amount you can utilize for the credit by the contribution amount. My dependent child will turn 14 during the current plan year but will still have a babysitter throughout the plan year.

Some of the expenses covered include senior care child care babysitting beforeafter-school programs and sick. The pre-tax deductions reduce an employees taxable income and can be used for qualified medical expenses for them their spouses and their dependents. Qualifying childcare expenses used towards the Child and Dependent Care Credit was expanded to 16000 and the percentage of expenses that are eligible for the credit was increased to 50.

My dependent child who is under age 14 goes to private school. You would enter 5000 on line 12 and 50 the amount forfeited on line 14. In other words using a.

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Health Care And Dependent Care Fsas Infographic Optum Financial

Dependent Care Flexible Spending Account

Worried About Using Up Your Childcare Fsa Funds Bri Benefit Resource

Flex Spending Accounts Hshs Benefits

How A Dependent Care Fsa Can Enhance Your Benefits Package

Flexible Spending Account Nuesynergy

Getting The Most Out Of Your Child Care Fsa Quality For Kids

Save Money With A Flexible Spending Account Fsa Youtube

Coh Dependent Care Reimbursement Plan

Tax Free Savings Accounts Bsw Benefits Baylor Scott White Health

Dependent Care Fsa Flexible Spending Account Ppt Download

Connectyourcare Why Employers Should Offer A Dependent Care Fsa

Your Flexible Spending Account Fsa Guide

Dependent Care Assistance Program Optum Financial

How To Use A Dependent Care Fsa When Paying A Nanny

Your Dependent Care Fsa Babysitter Hiring Options Bri Benefit Resource

Post a Comment for "How To Use Dependent Care Fsa Funds"