When Do You Make A Section 754 Election

743b upon the transfer of a partnership interest caused by a partners death. 734 b and 743 b shall be made in a written statement filed with the partnership return for the tax year during which the distribution or transfer occurs.

Advantages Of An Optional Partnership Basis Adjustment

October 13 2017 by Ed Zollars CPA.

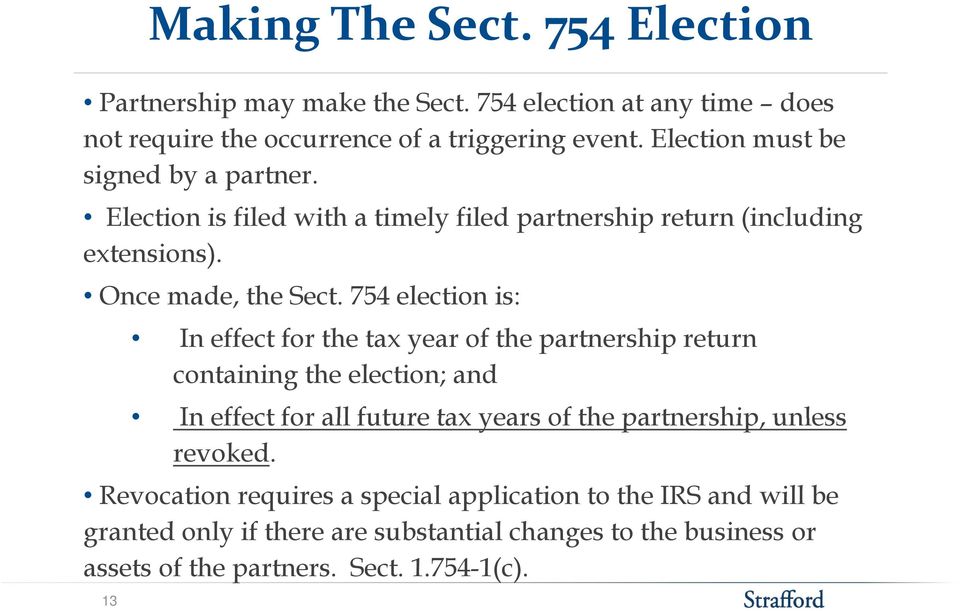

When do you make a section 754 election. In the hedgeprivate equity space a Section 754 election could be made in a time when the fund is in a net appreciated position but the markets could change and the fund could find itself in a net depreciated position when Section 743 or 734 transactions occur. The Section 754 election must be made before the due date of the income tax return including extensions for the year in which the transfer occurs. 1 An election under section 754 and this section to adjust the basis of partnership property under sections 734b and 743b with respect to a distribution of property to a partner or a transfer of an interest in a partnership shall be made in a written statement filed with the partnership return for the taxable year during which the distribution or transfer occurs.

If the partnership makes a 754 election the estate or successor partner adjusts his share of the inside basis of partnership assets to equal its outside basis. 754 election can also be made when a members interest is sold or upon certain distributions of partnership assets. Go to Form Sch K-1 1065.

Under proposed regulations on which taxpayers may rely upon immediately elections made by partnerships under IRC 754 will no longer have to be signed by a partnership representative REG-116256-17. 1754-1b to apply the provisions of Code Secs. Your post is a bit confusing.

Making the Election. Section 754 Election Statement Taxpayer Name Taxpayer Address Taxpayer City Taxpayer State ZIP Code Identification Number. This is very complex.

At least to me anyway. 1754-1 b For partnerships this is on or before the fifteenth day of the fourth month following the close of the partnerships taxable year. This step-up in basis is used to make the outside basis basis of the partnership in the hands of the owner equal to the inside basis the basis of the assets in partnership.

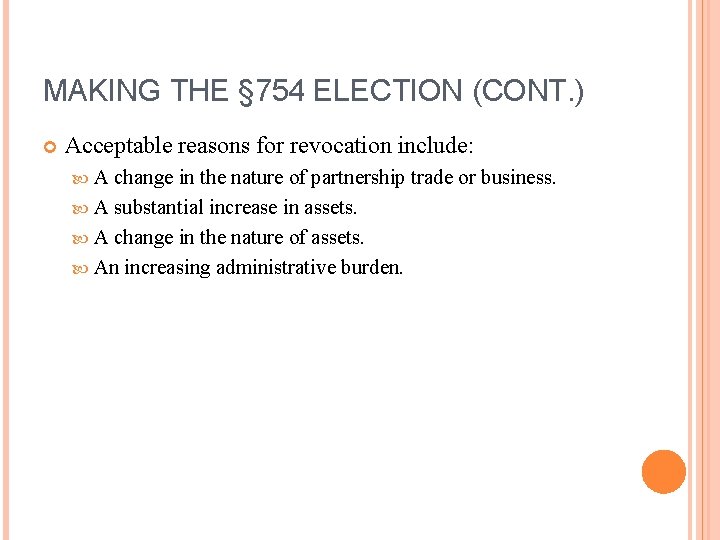

16031 a1 e Courts have been stringent in this requirement. Under the Section 754 regulations however an application to revoke the election will not be approved if the revocations primary purpose is to avoid stepping down the basis of partnership. Making a Valid Sec.

The election is effective beginning with the tax year ending Year End. This allowed us to reduce current income allocated to us and reduce taxable gain on the disposition of the partnerships assets. 754 Election Following a Transfer of a Partnership Interest.

Distribution of partnership property or transfer of an interest by a partner. It is not uncommon for a partnership to attempt to make a valid Sec. Select the Ln 13d Sch K - Oth Ded tab.

Up to 20 cash back We need to amend a Form 1065 to include a Sec. The successor partner acquires a basis in his share of the underlying partnership assets as if he had purchased an undivided interest in them at market value on the date of death. 754 provides an election to adjust the inside bases of partnership assets pursuant to Sec.

47408-47409 October 12 2017. ID Taxpayer Name hereby elects under Code Sec. Select the Yes check box on Line 12a - Is the partnership making or had it previously made and not revoked a section 754 election.

In order to make a valid election the return must be timely filed. 754 election only to find that it failed to satisfy regulatory requirements. Section 734 Making the Section 754 Election.

Need more information to try to help with your question. Report Inappropriate Content. Select the Special Alloc tab.

The purpose of a Section 754 election is to reconcile a new partners outside and inside basis in the partnership. Sec 754 Depreciation select 0 - By Amount or a Special Allocation number from the Special Allocation drop-down menu. While the tax matters partner would ordinary have the authority to make a 754 election in the absence of a binding partnership agreement or resolution of the partnership governing this issue if there is no express statement one way or the other the choice would generally be vested in the discretion of the tax matters partner.

Here is a link explaining the 754 election. 754 election is not. When the 2017 return was due the appraisals for all the properties were not completed.

See the two articles below and see if they help at all. A few years after my mothers death the partners sold one of the properties. Under Line 13 - Code W Items.

1754-1 b 1 26 CFR 1754-1 httpswwwlawcornelleducfrtext261754-1 provides that an election under Sec. Under Section 754 a partnership may elect to adjust the basis of partnership property when property is distributed or when a partnership interest is transferred. 754 to adjust the basis of partnership property under Secs.

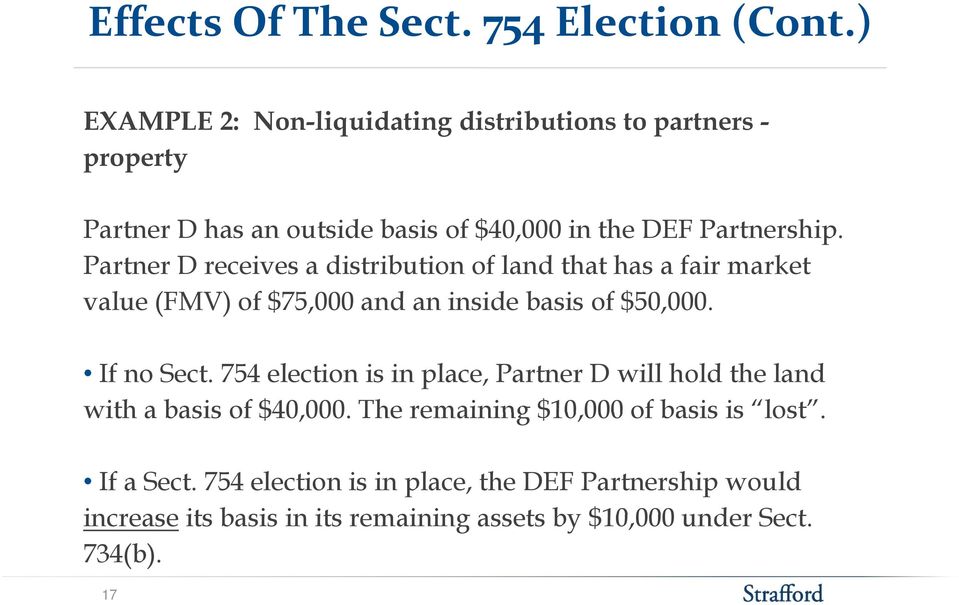

I would guess that an estate can have an interest in a partnership but the estate must distribute that interest. This site uses cookies to store information on your computer. A Section 754 election applies to all property distributions and transfers of partnership interests during the partnership tax year for which the election is made plus for all later tax years unless revoked.

I know we have an automatic 12 month extension from the due date to file the amended return and make the 754 election. After consulting with a CPA we decided to make a section 754 election to step up our basis in the partnership assets. The Section 754 election must be made in a statement that is filed with the partnerships timely filed return including any extension for the tax year during which the distribution or transfer occurs.

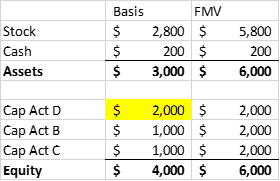

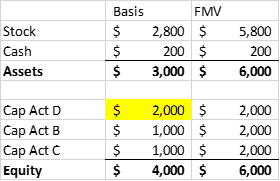

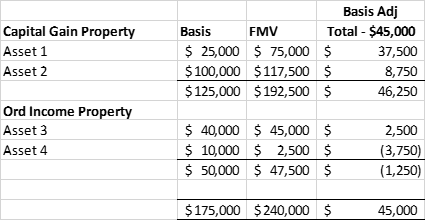

B Time and method of making election. If Partnership ABC makes a section 754 election it increases its basis in the Investment by the excess of the basis of the real estate in the hands of the partnership 300K over its basis to A 200K 22. Section 754 allows a partnership to make an election to step-up the basis of the assets within a partnership when one of two events occurs.

The partnership includes other partnerships that own shopping centers. To remedy this a partnership may make a 754 election under Internal Revenue Code sections 743 b and 734 b to equalize the buyers basis in the purchased partnership interest in property outside basis and the buyers share of the basis of the assets inside the partnership net of liabilities inside basis. Entering Section 754 Basis Adjustment.

The current regulations require that the election be signed which has created issues with electronically filed.

Partnership Taxation What You Should Know About Section 754 Elections

Section 754 And Basis Adjustments Pdf Free Download

Consequences Of A Section 754 Election

Making A Valid Sec 754 Election Following A Transfer Of A Partnership Interest

Chapter 13 Basis Adjustments To Partnership Property Basis

Chapter 13 Basis Adjustments To Partnership Property Basis

Section 754 Elections Theory Practice Youtube

Partnership Taxation What You Should Know About Section 754 Elections

Gifts Of Partnership Interests

Section 754 And Basis Adjustments Pdf Free Download

Partnerships And S Corporations Ppt Download

Section 754 And Basis Adjustments Pdf Free Download

Section 754 And Basis Adjustments Pdf Free Download

Advantages Of An Optional Partnership Basis Adjustment

754 And Basis Adjustments For And Llc Interests

Section 754 And Basis Adjustments Pdf Free Download

Consequences Of A Section 754 Election

An Alternate Route To An Ipo Up C Partnership Tax Considerations Part 2

Chapter 2 Partnership Formation And Computation Of Partner Basis Ppt Video Online Download

Post a Comment for "When Do You Make A Section 754 Election"