Nol Carryforward Rules 2019

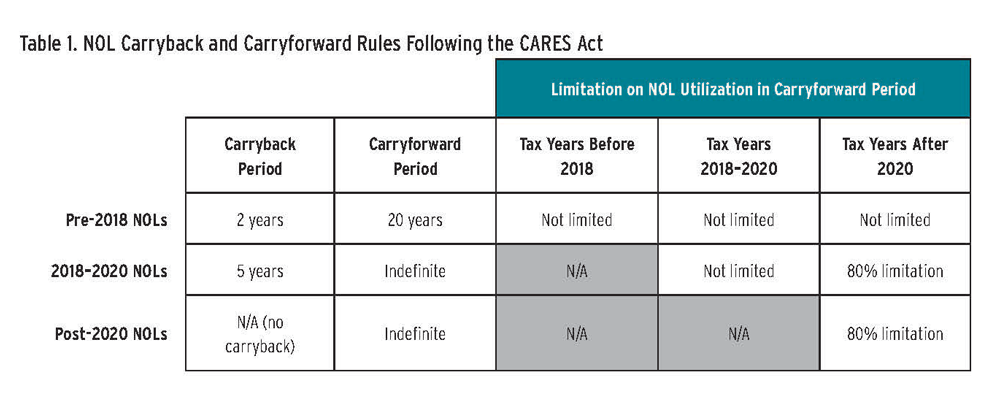

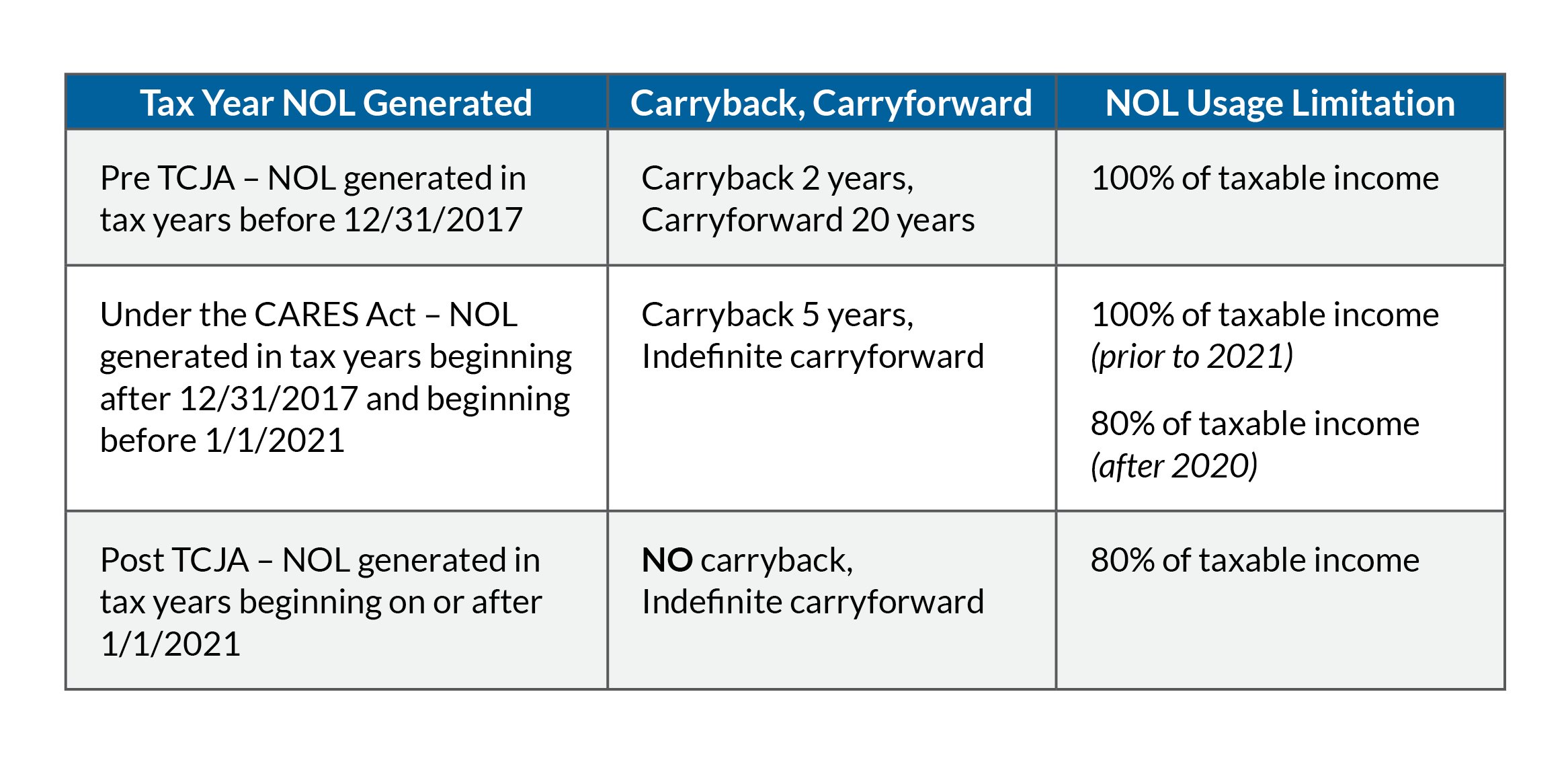

A taxpayer must make an election either to exclude section 965 years from the carryback period for an NOL arising in a taxable year beginning in 2018 or 2019 or to waive the carryback period for such an NOL by the due date including extensions for filing its return for. This indefinite carryforward period includes any NOLs from 2018 2019 and 2020 that remain after they are carried back to tax years in the five-year carryback period.

Nol Net Operating Loss Carryforward Explained Losses Become Assets

Again this is more consistent with the way that the SRLY rules apply to NOL and capital loss carryforwards.

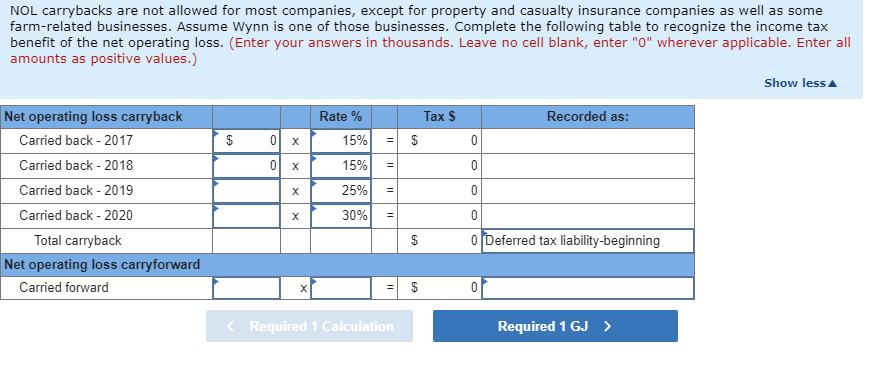

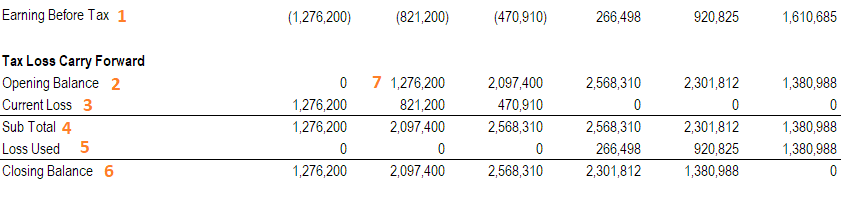

Nol carryforward rules 2019. You have an NOL of 4000. PNOLCCs have a carryforward period of up to 20 tax years following the year of the initial loss. A tax loss carryforward is a tax policy that allows an investor to use realized capital losses to offset the taxation of capital gains in future years.

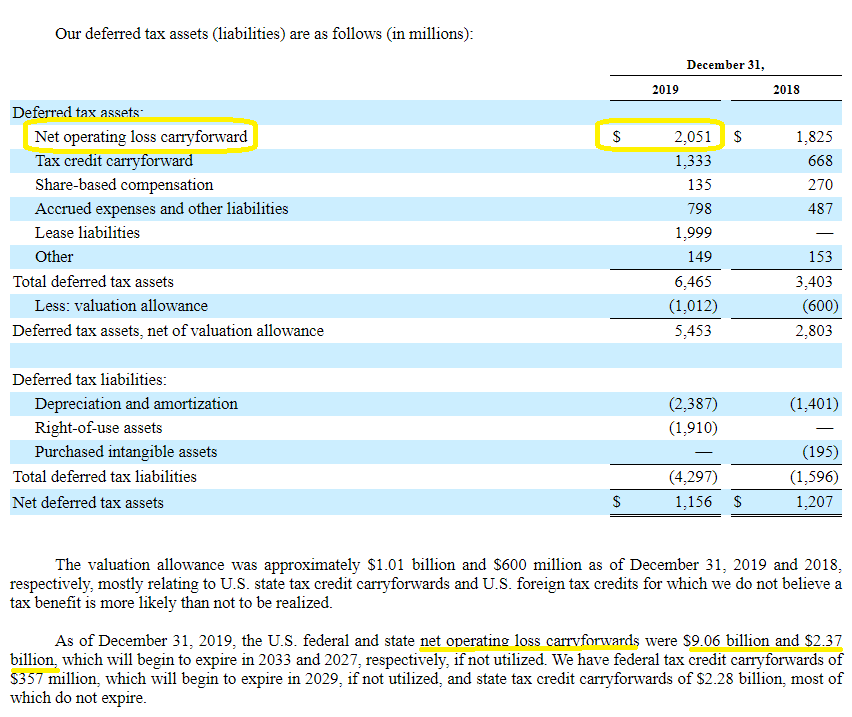

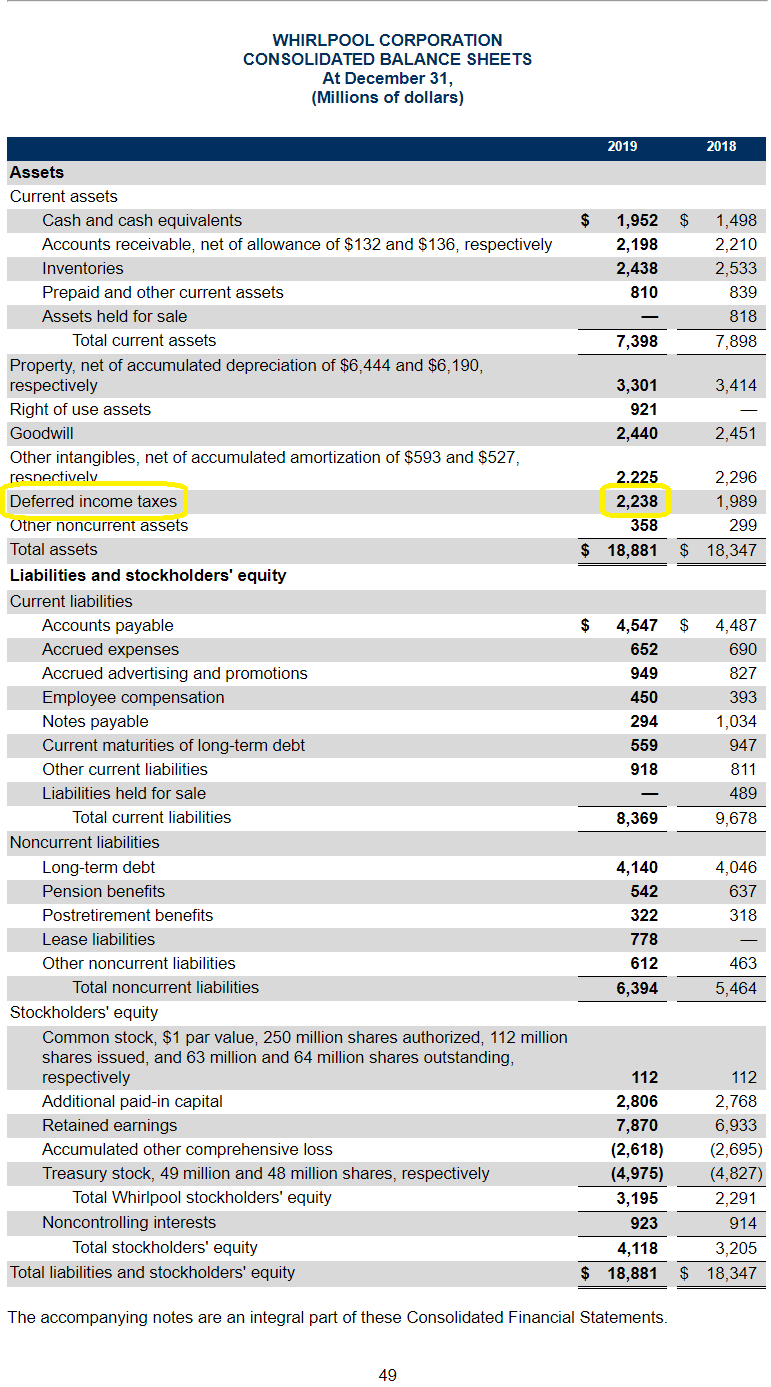

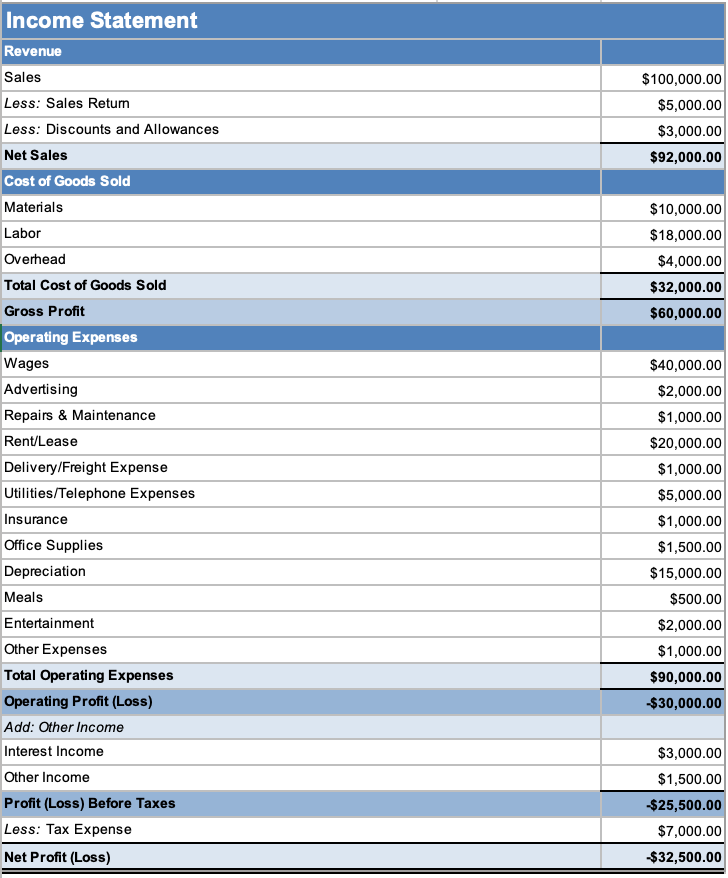

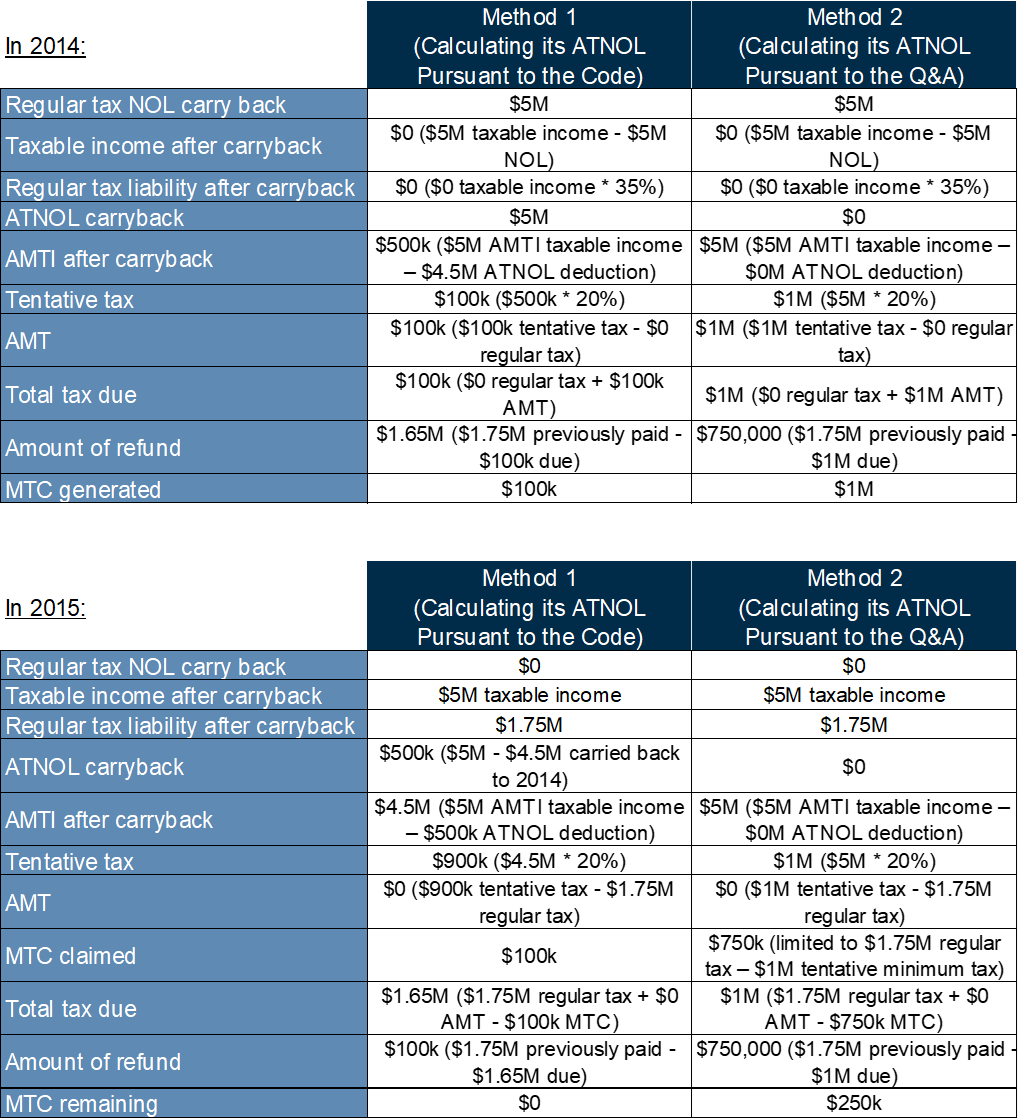

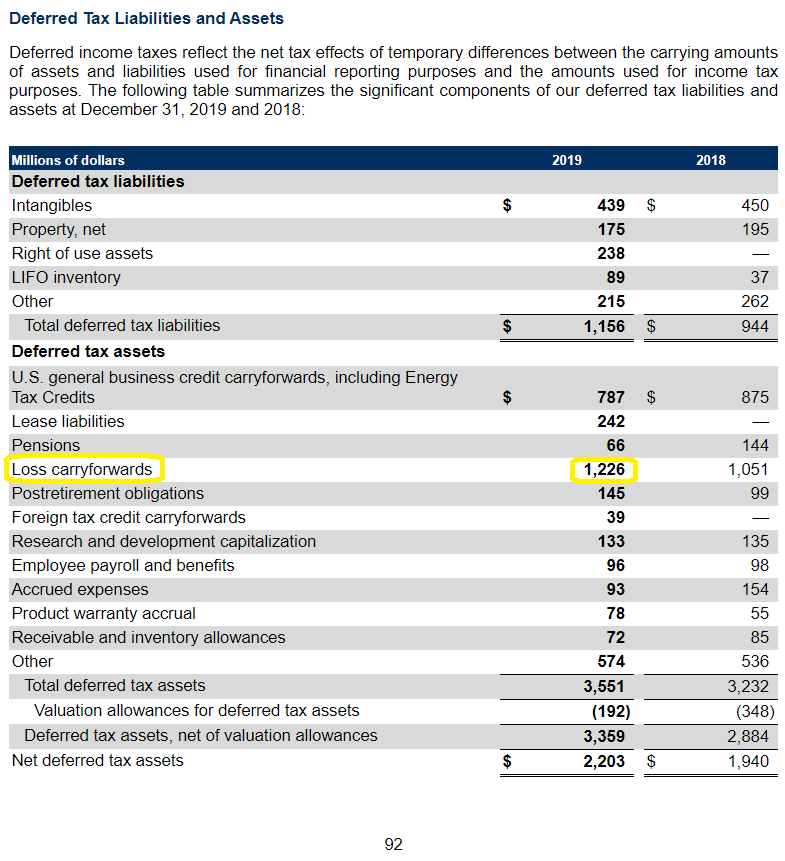

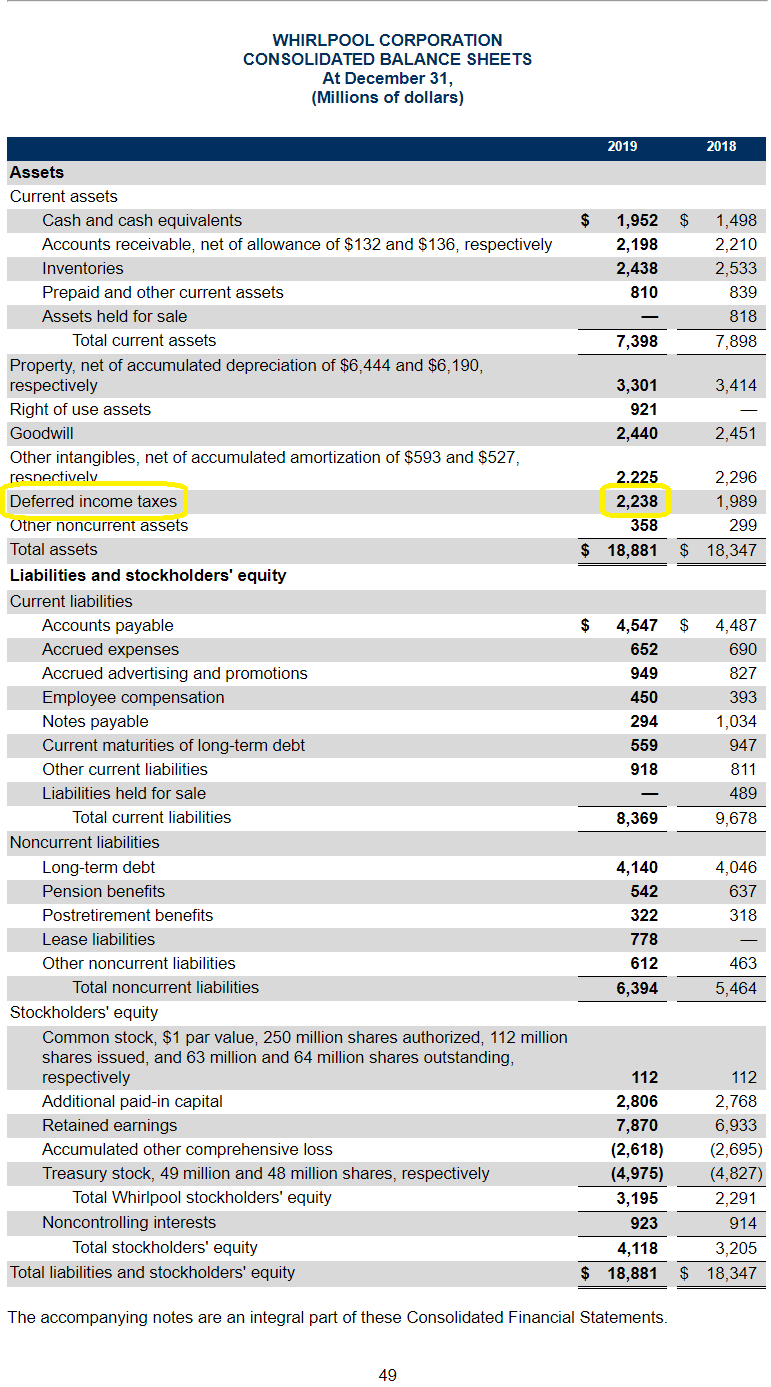

A federal NOL deduction for losses incurred in tax year 2018 or later is limited to 80 of the current year federal taxable income computed as if the changes to the IRC. He had no long- term AMT refundable credit in 2010. Its total profit before tax in 2018 and 2019 combined was zero yet it paid 3 million in taxes.

When an asset is sold. 2019 estimated tax rules changed to generally follow federal guidelines for individuals. New York State personal income taxpayers must recompute their federal NOL deduction using the rules in place prior to any CARES Act or subsequent federal changes.

Partnerships and S corporations. Post-allocation NOLs arising from tax periods ending on or after July 31 2019 can only be applied to. If you have an NOL you have 2 options.

Disease 2019 Pandemic as well as the additional relief provided in IRS Notice 2020-20 and Notice 2020-23. Carrybackcarryforward an NOL deduction. Net operating loss NOL carryforward.

The taxpayer would have received a benefit from the NOL for the 2019 tax year. NOLs incurred in taxable years beginning on or after January 1 2013 and before January 1 2019 were carried back to each of the preceding two taxable years or elected to carryforward for 20 years. Xs long- term unused minimum tax credit was 6000 in 2011.

A corporation incurred a 50 expenditure in 2018 and claimed the entire amount as a deduction on its 2018 tax return. However your NOL may not reduce your taxable income for any future year by more than 80. Carryback your NOL deduction to the past 2 tax years by filing your amended returns and carryforward any excess.

Under the TCJA rules the NOL must be carried forward. You may deduct this NOL in any number of future years until it is used up. 9 Post-allocation NOLs created in tax periods ending on or after July 31 2019 are also subject to a carryforward period of up to 20 tax years.

Taxpayers that own a subsidiary with a SRLY-limited BIE carryforward should consider the impact of intercompany transactions to help or hurt the SRLY cumulative register. 6000 was attributable to 2007 and 4000 was attributable to 2008. Creation and use of net operating loss NOL.

Tax Loss Carryforward. The allowable NOL carryback percentage varied. A company that had a loss of 10 million in 2018 and a profit of 10 million in 2019 with a 30 tax rate would pay zero tax in 2018 and 3 million in 2019.

Should taxpayers carryback an NOL. The deduction increases the corporations NOL carryforward from 100 to 150. Whether a taxpayer should carryback an NOL using the CARES Act rules depends on the taxpayers situation.

2019 and after NOL can no longer be carried back to the past 2 years. For taxable years beginning on or after January 1 2019 NOL carrybacks are not allowed. Deductions minus Form 1045 removed items minus total income NOL 21000 - 11500 - 5500 4000.

If the taxpayer had taxable income in the 2019 tax year the 2018 NOL carryforward would probably have been used on the 2019 tax return. NOL and provides specific rules about how to perform a Net Operating Loss carryforward. For losses incurred in tax years.

The corporation used the entire 150 NOL carryforward on its 2019 tax return. X has a minimum tax credit carryforward to 2011 of 10000.

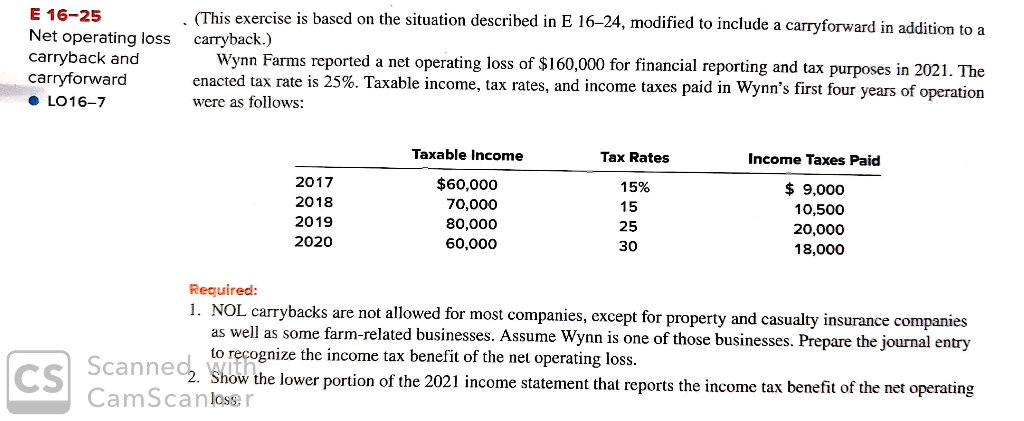

Solved Wynn Farms Reported A Net Operating Loss Of 160 000 Chegg Com

Cares Act Relief May Result In Difficult Choices For Multinational Taxpayers Insights Vinson Elkins Llp

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

1040 Net Operating Loss Faqs Nol Schedulec Schedulee Schedulef

A Small Business Guide To Net Operating Loss The Blueprint

1040 Net Operating Loss Faqs Nol Schedulec Schedulee Schedulef

Nol Carrybacks Under The Cares Act Tax Executive

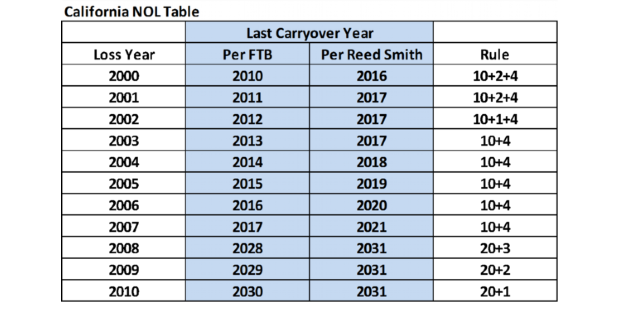

California Net Operating Loss Opportunities Perspectives Reed Smith Llp

Net Operating Loss Carrybacks And Carryforwards Tax Foundation Of Hawaii

Net Operating Loss Nol Carryover Deduction San Jose Cpa

Irs Issues New Non Binding Guidance On Nol Carrybacks Alvarez Marsal Management Consulting Professional Services

Nol Net Operating Loss Carryforward Explained Losses Become Assets

Cares Act Five Year Nol Carryback Rules Will Have Significant Impact On M A Transactions Lexology

Nol Net Operating Loss Carryforward Explained Losses Become Assets

Cares Act International Tax Implications Of Nol Rule Changes Rkl Llp

Solved E 16 25 Net Operating Loss Carryback And Carryforward Chegg Com

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

The Cares Act Summary Of Tax Provisions Michael Best Friedrich Llp

Post a Comment for "Nol Carryforward Rules 2019"