Salary Of Mp Is Taxable Under

The taxable value is as under. Apart from the basic salary an MP will receive 70000 as constituency allowance in addition to many other perks.

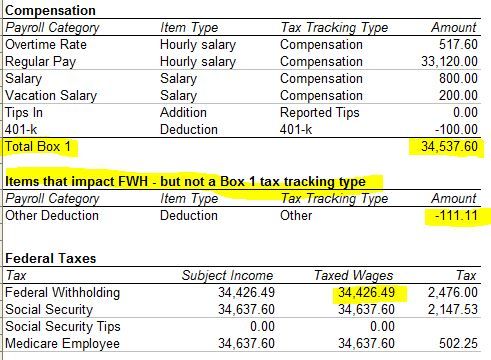

Solved W2 Box 1 Not Calculating Correctly

In 2018 through the Finance Act Parliament amended the law setting the salary for MPs.

Salary of mp is taxable under. Yes the salaries received by MPs and MLAs are taxable in India and only salaries and not the other payments. 6 Chief Justice of India 280000 US3700 Not Applicable 9 Judges of the Supreme Court. Actual cost of Running and Maintenance of motor car.

For charging an income under the Head Income from Salary there must be an employer-employee relationship between the payer and payee. 2 Further in 1985 Parliament enacted a law that delegated the power to set and revise certain allowances of MPs. Any charges recovered from the employee.

280000 US3700Basic Pay received as a Member of Parliament in Lok Sabha or Rajya Sabha Allowances as a Member of Parliament Other allowances fixed to the Prime Minister. Spanish MPs living outside of Madrid however earn two-thirds of their basic salary 33768 euros again in a tax-free lump sum for expenses 21886. However taxpayers can also avail tax benefits under various sections of the Act.

What would be considered taxable for an average employee may well be tax free for an MP depending on the type of expense you are talking about. In case of any salary arrears are they taxable. In the case of tax-free salary the pay income along with the tax will be a part of the revenue from the pay of the employee.

3 An employee whose monetary income under the salary exceeds Rs. 4 Governors 350000 US4600 Other allowances fixed to Governors. 50000 Monetary Income means Income chargeable under the salary but excluding perquisite value of all non-monetary perquisites.

To reap these benefits one must understand the income tax slab and applicable rates. If such relationship does not exist then income will not be taxable under the head salary. Under Section 80C of the Income Tax Act exemption of up to Rs15 lakh is provided.

May be that they receive remunerations after swearing in but then it cannot be said to be salary within the meaning of section 15 and therefore the remuneration received by the MLA or MP cannot be taxed under the head Income from salary but can be taxed under the head Income from other sources. An MP also gets a secretarial allowance of 60000 per month. Once the employee accrues the salary the liability to pay tax cant be exempted by any means.

It revised their salary and provided that the salary daily allowance and pension of MPs shall be increased every five years based on the cost inflation index provided under the Income-tax Act 1961. How salary of MP MLA and Judges are taxable in India. 2 Further in 1985 Parliament enacted a law that delegated the power to set and revise certain allowances of MPs.

In 2018 through the Finance Act Parliament amended the law setting the salary for MPs. However all the daily allowances and all other allowance received by. Any income can be taxed under the head salary only if there is an employer and employee relationship between the payee and payer.

Similarly salary received by a person as MP or MLA is taxable as Income from other sources but if a person received salary as Minister of State Central Government the same shall be charged to tax under the head Salaries. Pension received by an assessee from his former employer is taxable as Salaries whereas pension received on his. The basic annual salary of an MP in the House of Commons is 81932.

The surrendered salary of the employees is exempt from the tax. Normal wear and tear 10 per annum of the actual cost of motor car. MPs have a much more generous set of rules when it comes to the tax treatment of their expenses and allowances.

22 March 2011 Pension recd by Ex MPs and MLAs from the Govt is taxable as Income from Other Sources since there is not employer-employee relationship between the MPsMLAs and the government. If motor car is owned by the employee but running and maintenance and drivers salary reimbursed by employer. The state of Madhya Pradesh levies professional tax of Rs202 for first 11 months and professional tax of Rs212 for the last month for individuals with salary above Rs15000.

3h2 The salary and daily allowance of members shall be increased after every five years commencing from 1st April 2023 on the basis of Cost Inflation Index provided under clause v of Explanation to section 48 of the Income-tax Act 1961 4. However all the daily allowances and all other allowance received by the MPs and MLAs are fully exempt. Salary earned from multiple employers can be clubbed together.

There had been attempts since the late 18th century to provide salaries. It revised their salary and provided that the salary daily allowance and pension of MPs shall be increased every five years based on the cost inflation index provided under the Income-tax Act 1961. SALARY OF EX MP M L A.

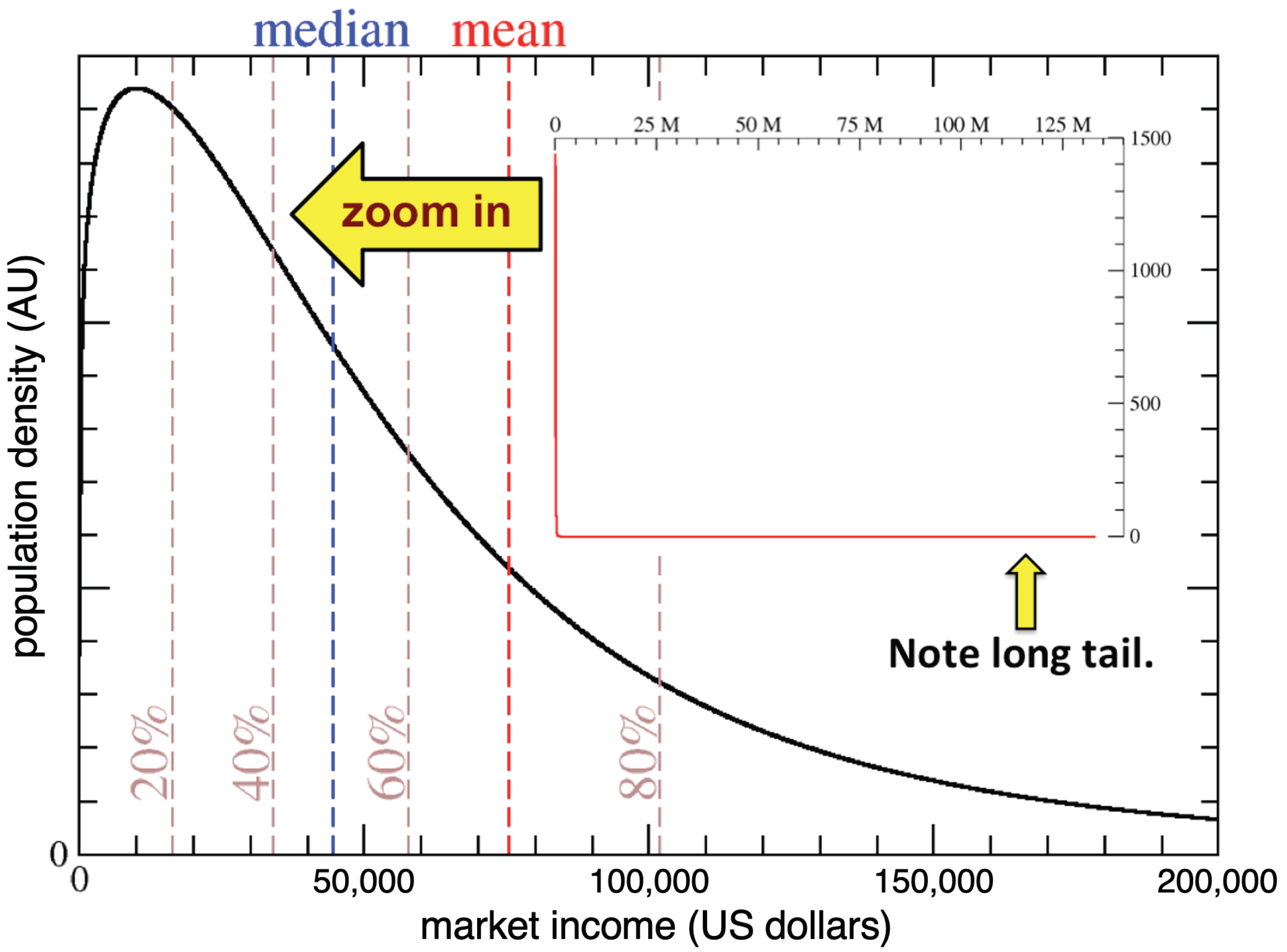

Members of parliament were unpaid until 1911 as it was assumed they had independent means which restricted membership of Parliament to well-off men. However no exemption is provided under the new tax regime. Income tax payment for individuals and corporate entities is a mandatory requirement as per the Income Tax Act 1961 if their annual income is above the minimum exemption limit.

A QSEHRA can reimburse any medical expenses as defined in IRC 213 d incurred by an employee or the employees family as determined under. Last Modified on May 8 2014 by Editorial Staff. Are Food and Beverage exemption provided under the.

Slovakia which has a. Travelling Allowance1 There shall be paid to each member in respect of every. The salaries of MPs are taxable under the head Income from other Sources and not Income under the head Salaries.

The maximum annual benefit is prorated for employees not covered by the QSEHRA for the entire year eg new hires. Whether Salary or remuneration received by MPs and MLAs is taxable under the Head Income from Salary or Income from Other Source. There is no specific exemption for such a pension.

Yes salary arrears are taxable. The salaries of MPs are taxable under the head Income from other Sources and not under the ehad Salaries. However relief is provided under Section 89 of the Income Tax Act.

Top 10 Luxury And Affordable Best Hotels In Mombasa County 4 Best Hotels Lido Beach Resort Beach Hotels

Is It True That The Salary Of Ministers Mp Mla In India Are Tax Free Quora

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Statement Of Earnings And Leave

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Annual Compensation Vs Annual Salary

Hi Guys Got This Offer From Lti As Part Of Their Merger With My Company Can Anybody Understand And Explain What Will Be In Hand Salary As Per This With Or Without Tax

Kdf Soldier Salary Per Month In Ksh In 2021 Soldier Army Soldier Defence Force

Compensation Guide Minister S Program

What Is The Monthly Salary Of An Mla Cm Mp Pm And President Of India How Much Does They Get In Hand Every Month Quora

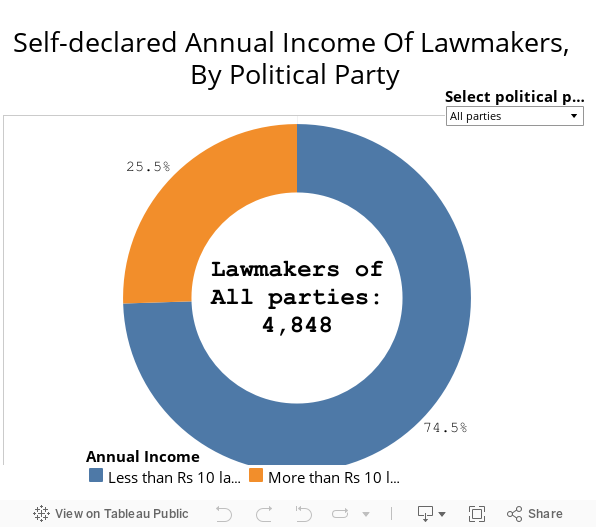

24 Percent Of Mlas And Mps Claim Exemption From Paying Income Tax Politics News Firstpost

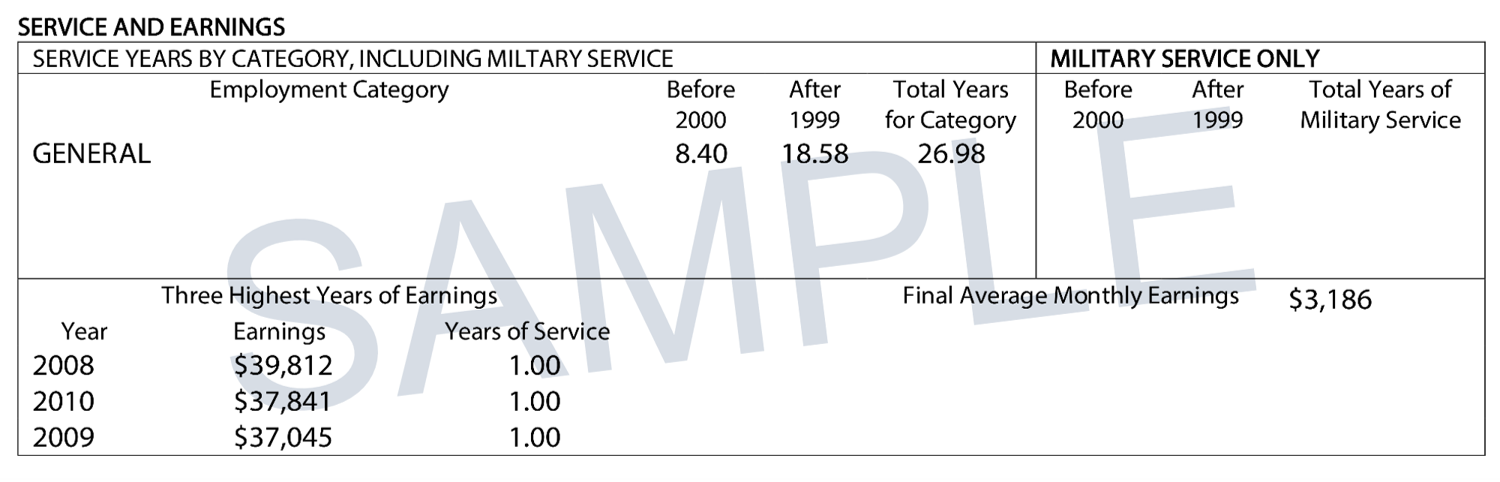

How To Fill Out Your Retirement Estimates And Application Etf

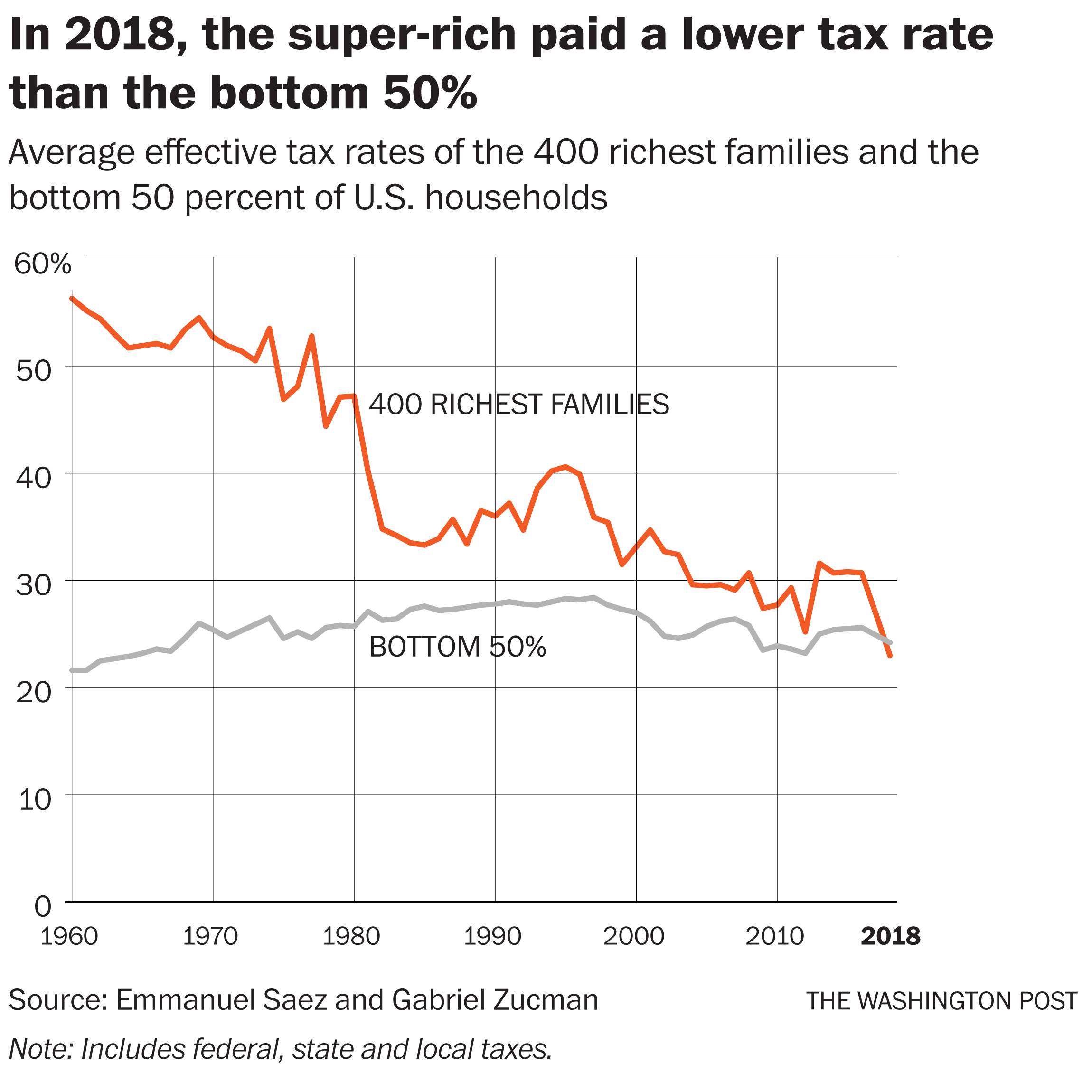

For The First Time In History U S Billionaires Paid A Lower Tax Rate Than The Working Class The Washington Post

Hi Guys Got This Offer From Lti As Part Of Their Merger With My Company Can Anybody Understand And Explain What Will Be In Hand Salary As Per This With Or Without Tax

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Taxable Items And Nontaxable Items Chart Money Life Hacks Income Accounting And Finance

Why Should Our Mps Enjoy Twin I T Exemptions When They Are Out Of Tds Regime Business News Firstpost

Is It True That The Salary Of Ministers Mp Mla In India Are Tax Free Quora

Post a Comment for "Salary Of Mp Is Taxable Under"