How To Record Monthly Depreciation

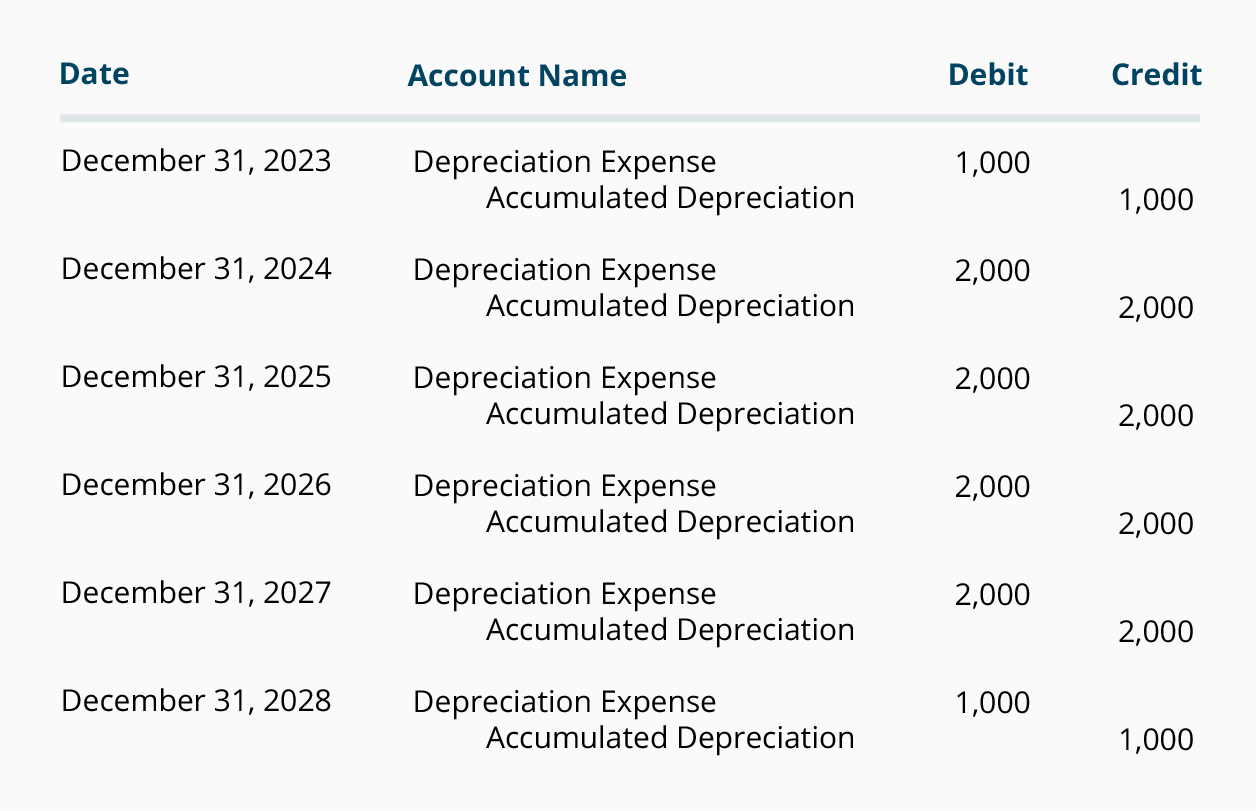

On every monthly income statement you can report 1000 on the depreciation expense line. Contra accounts are used to track reductions in the valuation of an account without changing the balance in.

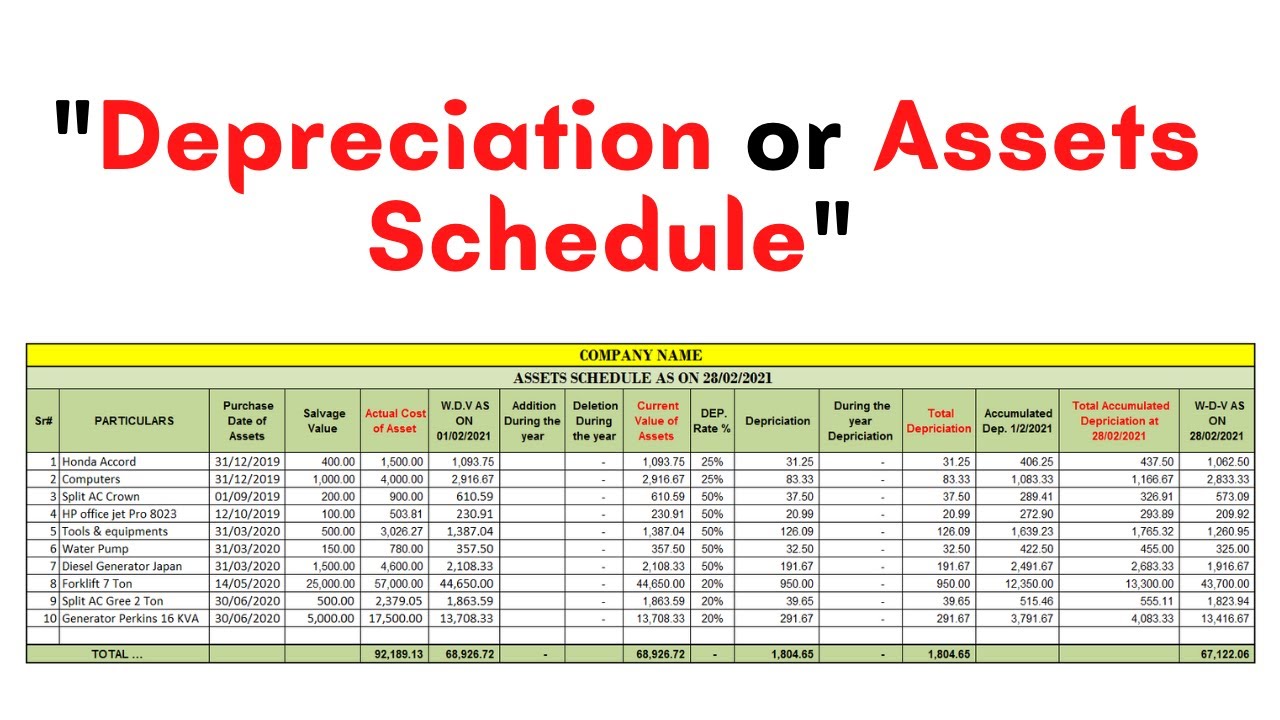

How To Prepare Depreciation Schedule In Excel Youtube

Go to Settings and select Chart of Accounts.

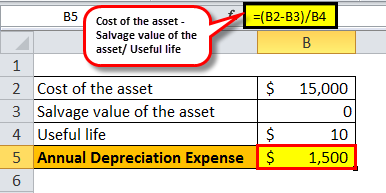

How to record monthly depreciation. For any further question p. Divide 100000 by 10 to get 10000 of depreciation per year Divide 10000 by 12 to get the 83333 of monthly depreciation Date your journal entry with the last date of the specified month. You only need to create these accounts once.

To ensure your accounts correctly reflect the value of the asset you can record the depreciation using journals. Prepare a journal entry to record straight-line depreciation for the MONTH of January. Wear and tear or physical deterioration results from use.

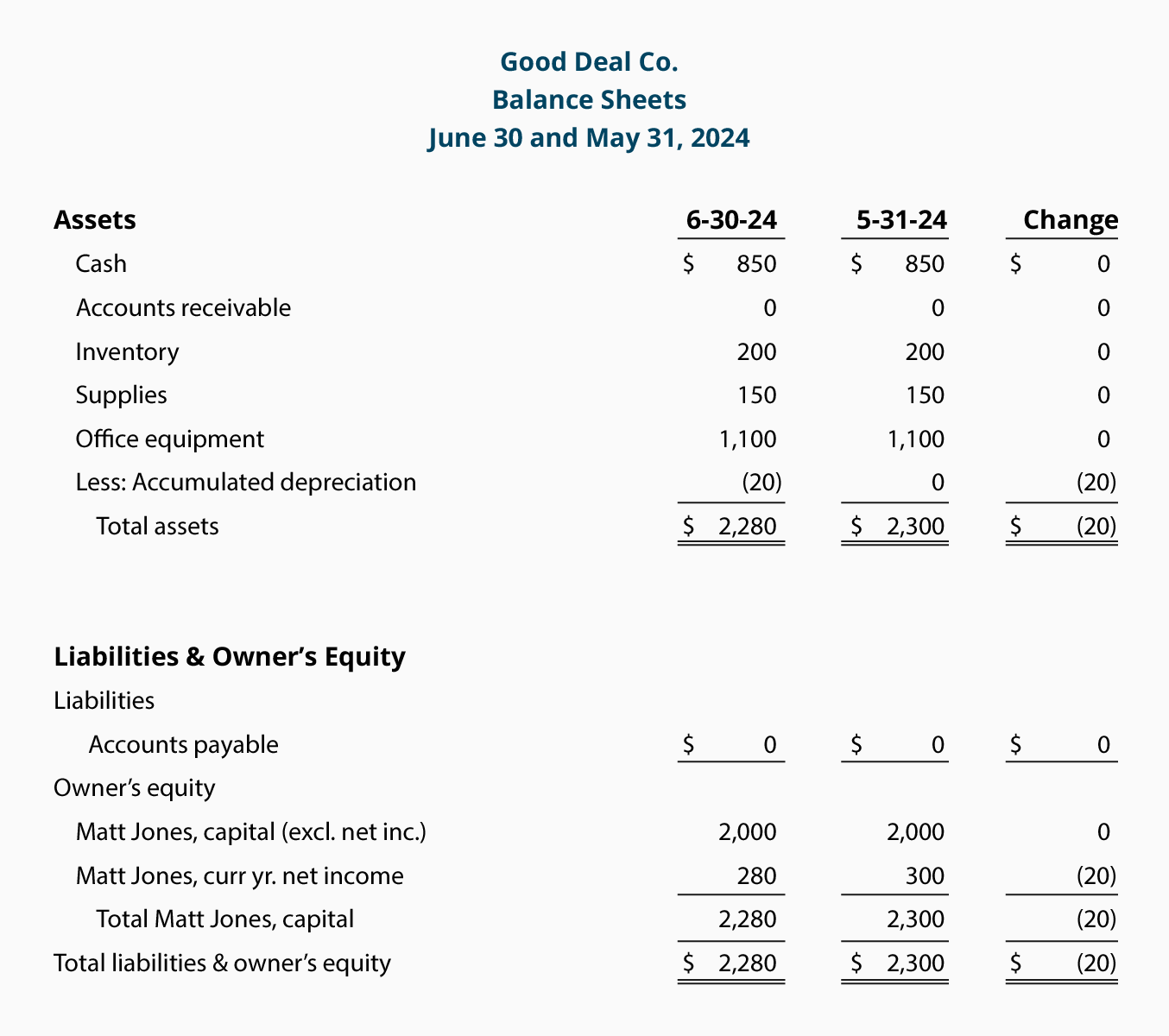

Over time these assets reduce in value which is known as depreciation. In the previous example dividing 11000 by 10 years equals 1100. This video will guide you how to record depreciation accumulated entries in QuickBooks and their impact on financial statements.

Equipment was purchased on January 1st for 6000 with an estimated life of 4 years and a residual value of 600. Its important that you know exactly how much your business is worth including the value of your assets. Most long term assets except for land have a limited useful life as a result of wear and tear and obsolescence and therefore depreciate over time.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Monthly depreciation 12005 12 20. Doing so makes it easier to calculate a standard half-month of depreciation for that first month of ownership.

Prepare a journal entry to record straight-line depreciation for the MONTH of January. Section 179 deduction dollar limits. How to record the depreciation journal entry 1.

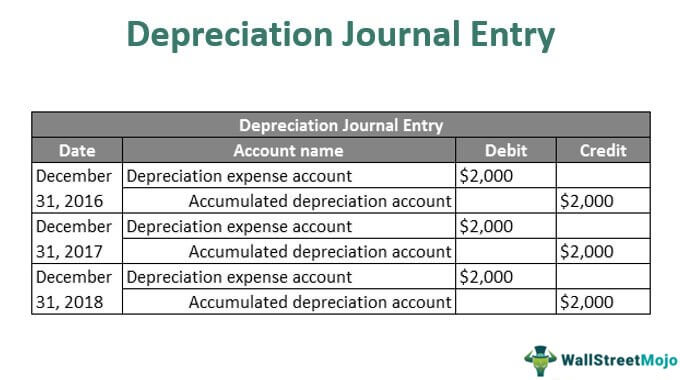

On the Lease summary page select a lease. Divide the result by 12 to. The basic journal entry for depreciation is to debit the Depreciation Expense account which appears in the income statement and credit the Accumulated Depreciation account which appears in the balance sheet as a contra account that reduces the amount of fixed assets.

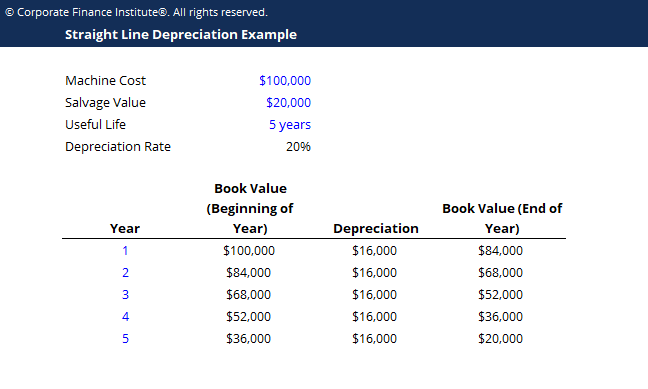

To record depreciation. A depreciation expense arises due to the reduction in value of a long term asset caused by its limited useful life. Divide the depreciable amount by the number of years of the assets estimated useful life.

Before you can record depreciation for an asset you need to create an asset account and an expense account for. For an example of the guidance for accounting standard compliance see the Calculation of ROU asset amortization expense for finance. The formula for the sum of years digits method is depreciable base multiplied by useful life remaining divided by sum of years digits.

You can use the straight-line depreciation method and divide the total cost by the number of months representing its useful life 420 months to obtain the monthly depreciation expense. Here n equals useful life. Over time the accumulated depreciation balance will continue to increase as more depreciation is added to it until.

Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation. If monthly overrides have been entered on any of your assets you can choose to have them applied or removed. Equipment was purchased on January 1st for.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is 26200. In this equation depreciable base equals cost basis minus residual value and sum of years digits equals n n12. Where depreciation account will be debited and the respective fixed asset account will be credited.

Note how the book value of the machine at the end of year 5 is the same as the salvage value. By doing so the two-half month depreciation calculations equal one full month of depreciation. Depreciation Journal Entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear normal usage or technological changes etc.

Give the account a name like Asset depreciation Select Save and Close. Create a new asset account. How Do I Record Depreciation.

The main objective of a journal entry for depreciation expense is to abide by the matching principle. This amount equals the depreciation expense for one year. When using the mid-month convention you should record a half-month of depreciation for the last month of the assets useful life.

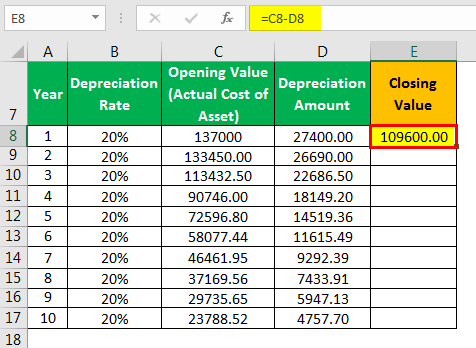

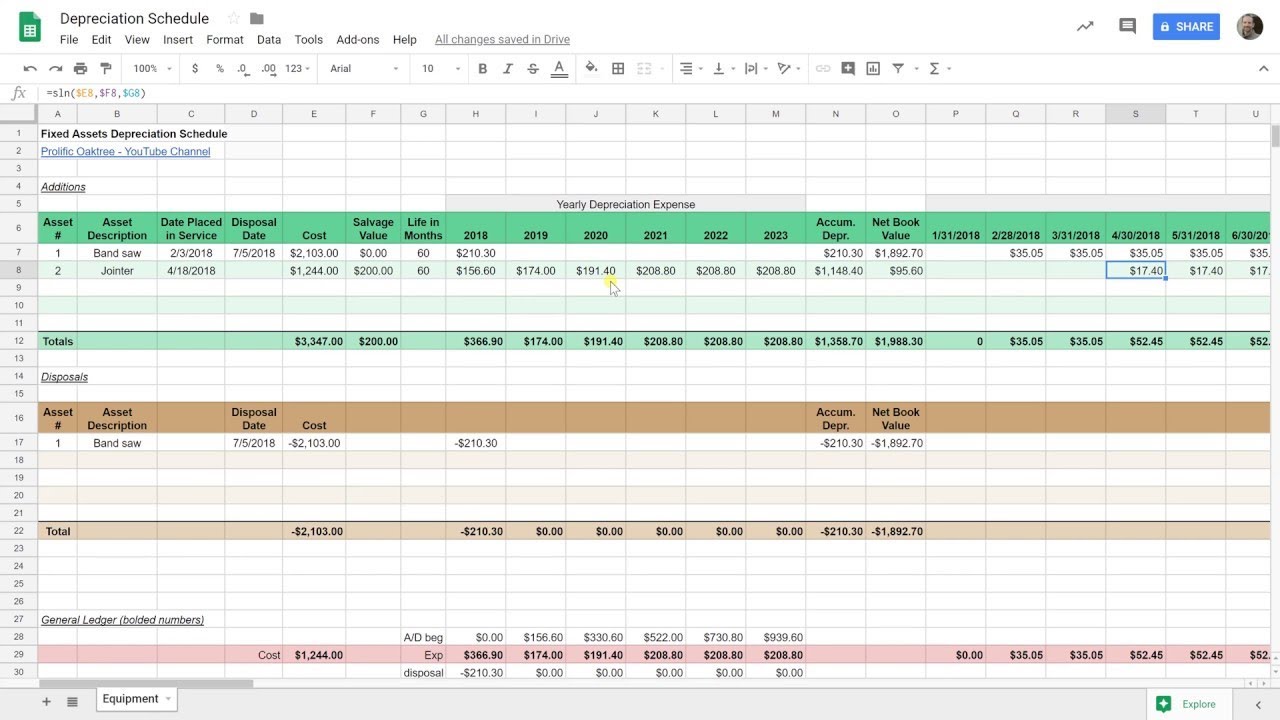

Asset Keeper Pro - Calculate Monthly Depreciation Calculate Monthly Depreciation - Step 1 of 1 The Calculate Monthly Depreciation option located on the home screen toolbar or off the Calculate menu allows you to calculate monthly depreciation for a selected method Book Federal etc. From my BEST-SELLING online course LEARN XERO IN A DAYIn this video I show you step-by-step how to enter the Depreciation of your Fixed Assets in XeroWant. Then select Books Asset depreciation schedule to open the Asset depreciation schedule page.

The ROU asset depreciation expense journal entry is based on the amount in the Depreciation Expense column. In this case the machine has a straight-line depreciation rate of 16000 80000 20. Recording the entry manually Even if youre using accounting software if it doesnt have a fixed assets module.

Your AccountEdge software doesnt calculate depreciation automatically but you can record your depreciation figures with a journal entry. We can calculate its monthly depreciation as follows. The depreciation rate is the annual depreciation amount total depreciable cost.

Assets can include items such as a car or expensive office equipment. Before you can record depreciation for an asset you need to create an asset account and an expense account for each type of asset you depreciate. If you havent already create an account to track depreciation.

From the Account Type dropdown select Other Expense. From the Detail Type dropdown select Depreciation.

Depreciation Formula Calculate Depreciation Expense

Pin By Endure Podcast On Entrepreneurship Small Business Finance Small Business Accounting Bookkeeping Business

The Small Business Accounting Checklist Infographic In 2021 Small Business Accounting Bookkeeping Business Accounting

Depreciation Journal Entry Step By Step Examples

View Monthly Detail For Fixed Asset Depreciation Calculation Depreciation Guru

Journalize Depreciation Financial Accounting

Unique Depreciation Spreadsheet Xls Xlsformat Xlstemplates Xlstemplate Budget Spreadsheet Spreadsheet Template Budget Spreadsheet Template

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Depreciation Journal Entry Step By Step Examples

Meaning Of Depreciation In Bookkeeping Small Business Bookkeeping Bookkeeping Bookkeeping Business

Straight Line Depreciation Accountingcoach

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

Monthly Depreciation Expense Journal Entries Depreciation Guru

Straight Line Depreciation Template Download Free Excel Template

Monthly Depreciation Schedule Template Inspirational Schedule Template Free Study Schedule Template Schedule Templates Schedule Template

Money Matters Shutha Monthly Expenses Expense Sheet Monthly Expense Sheet

Depreciation Expense Depreciation Expense Accountingcoach

Post a Comment for "How To Record Monthly Depreciation"