How Do You Calculate Monthly Depreciation Using Straight Line Method

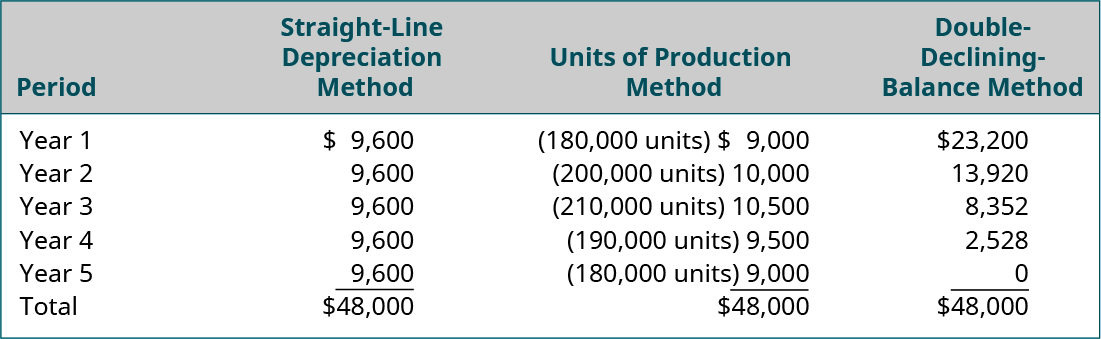

Lets take a look at an example. As with the straight-line example the asset could be used for more than five years with depreciation recalculated at the end of year five using the double-declining balance method.

What Is Depreciation And How Do You Calculate It Bench Accounting

IAS 16 does not.

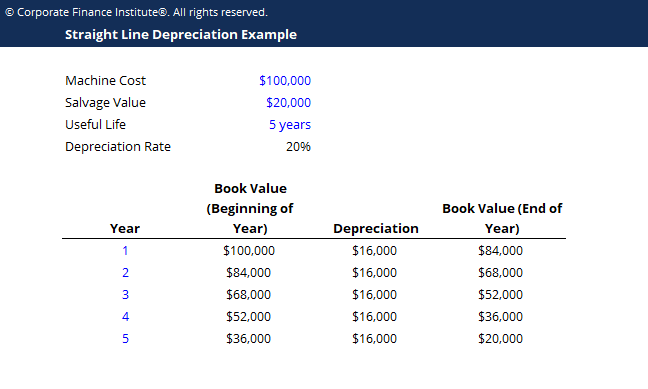

How do you calculate monthly depreciation using straight line method. IAS 16 states that you can depreciate the asset using the pattern reflecting its consumption. It represents the depreciation expense evenly over the estimated full life of a fixed asset. Using the straight line depreciation method the tractor would depreciate by 5000 per year for a total accumulated depreciation of 20000.

The company would be able to take an additional 10000 in depreciation over the extended two-year period or 5000 a year using the straight-line method. You can use a basic straight-line depreciation formula to calculate this too. We can represent contribution margin in percentage as well.

Once the book value equals the original salvage value it is considered a fully. You do not need to calculate monthly. Unit contribution margin per unit denotes the profit potential of a product or activity from the.

With the straight-line method you choose to depreciate your property an equal amount for each year over its useful life. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. Lets say you invest 1000 in an account that pays 4 interest compounded annually.

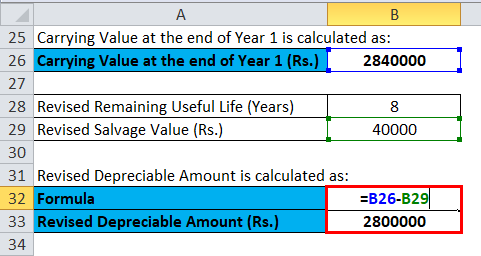

Lets break down how you can calculate straight-line depreciation step-by-step. However let me offer different solution. So in fact right now the asset is not used and therefore you can charge zero depreciation until you start using the asset.

This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm. Well use an office. From the information provided in the schedule below calculate the annual and monthly depreciation expense for all of the equipment assuming an expected useful life of 5 years using the straight-line sum-of-the-years digits double-declining balance and MACRS 3 and 5 year methods of depreciation.

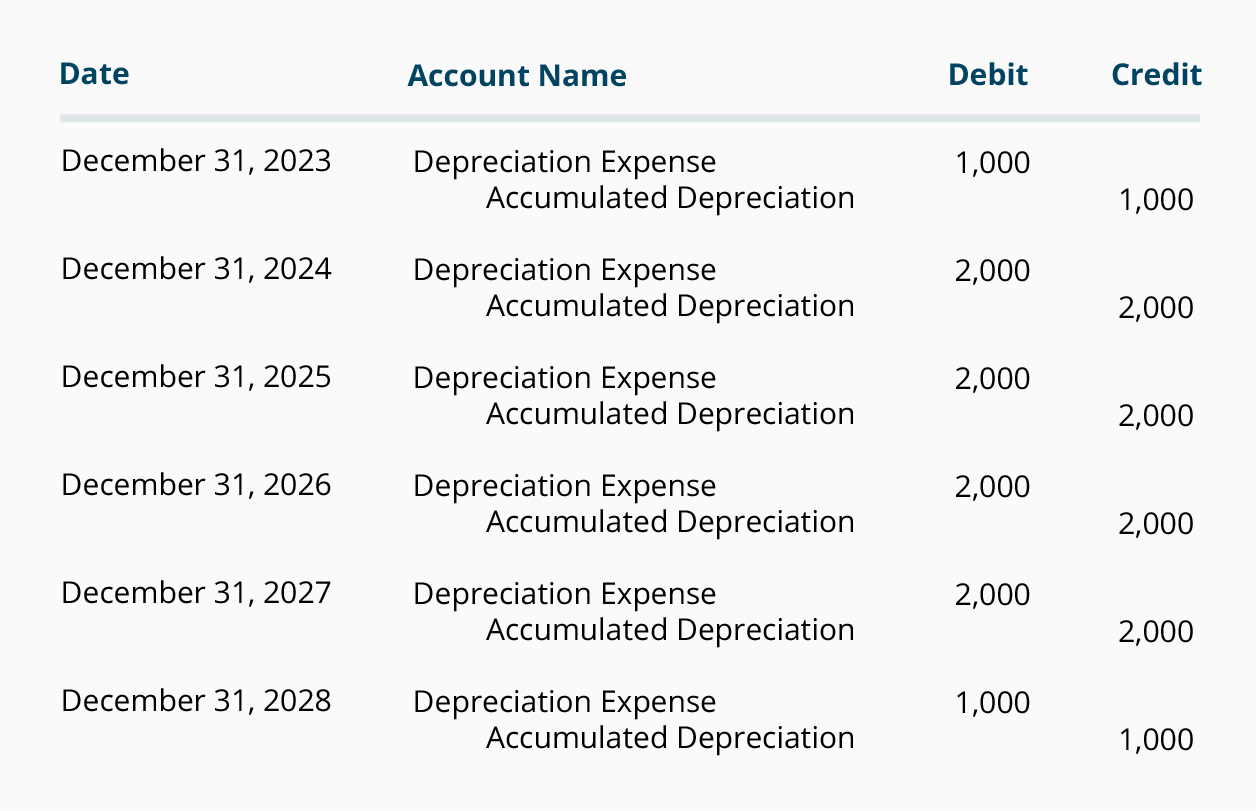

The depreciation expense appears on a profit and loss statement while the book value and accumulated depreciation accounts appear on a balance sheet. If you are compounding daily for example then be sure that you are working with a daily interest rate or if you are compounding monthly be sure that you are working with a monthly interest rate.

Depreciation Methods Principlesofaccounting Com

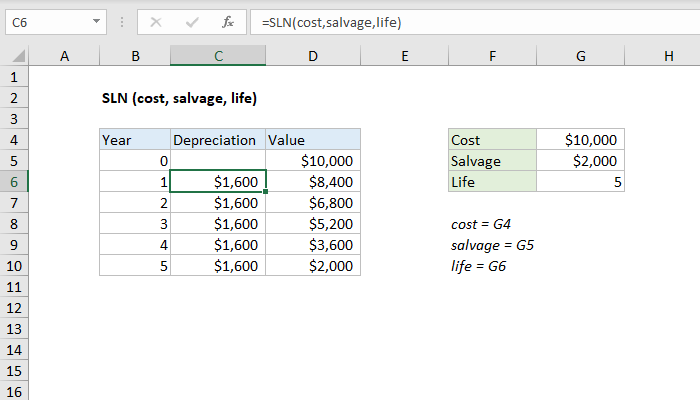

How To Use The Excel Sln Function Exceljet

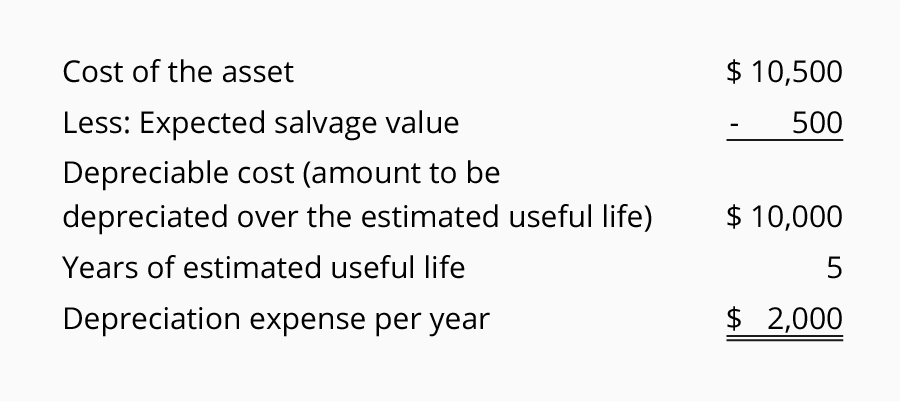

How To Calculate Straight Line Depreciation Depreciation Guru

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Tables Double Entry Bookkeeping

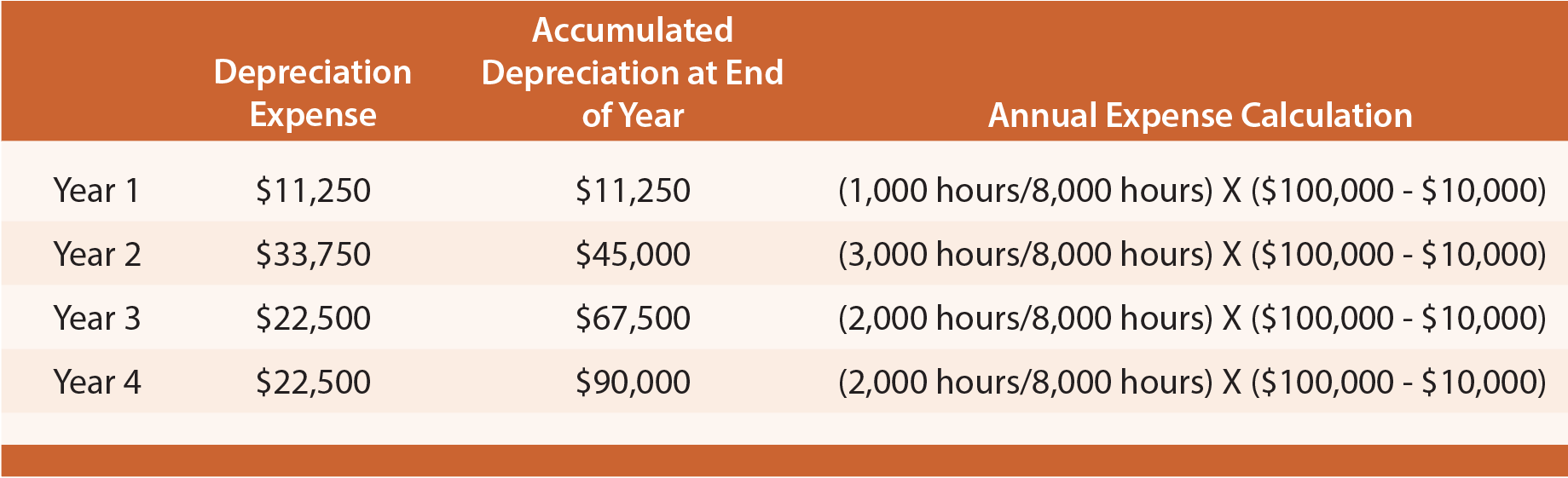

Explain And Apply Depreciation Methods To Allocate Capitalized Costs Principles Of Accounting Volume 1 Financial Accounting

What Is A Straight Line Depreciation How To Calculate Examples And Definition In Accounting Business Accounting

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Template Download Free Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Expense Double Entry Bookkeeping

Straight Line Depreciation Method Formula Example Video Lesson Transcript Study Com

Straight Line Depreciation Double Entry Bookkeeping

Straight Line Depreciation Accountingcoach

Lesson 7 Video 3 Straight Line Depreciation Method Youtube

Depreciation Formula Examples With Excel Template

Post a Comment for "How Do You Calculate Monthly Depreciation Using Straight Line Method"