Is Wage Subsidy Taxable Income Malaysia

Themed Malaysian Family Prosperous and Peaceful the spending accounts for 203 per cent of. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Covid 19 The Enhanced Wage Subsidy Programme Bdo

Tengku Zafrul says JaminKerja is expected to reduce unemployment to 4 percent.

Is wage subsidy taxable income malaysia. The Doing business in the United States guide provides newly enacted US tax law descriptions provisions updates to prior law and some practical insights for Federal tax issues. Income tax exemptions for winners of eligible e-sports championships. An additional levy of 1 is imposed on high-income earners without private health insurance.

117-2 March 11 2021 is a US19 trillion economic stimulus bill passed by the 117th United States Congress and signed into law by President Joe Biden on March 11 2021 to speed up the countrys recovery from the economic and health effects of the COVID-19 pandemic and the. By Fintan Ng. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

This note provides evidence on the importance of local action to help address the short-term and long-term consequences of the coronavirus COVID-19 outbreak. The first RM100 million in taxable earnings will be taxed at 24 while the remainder. Malaysias current low-wage structure is unacceptable given the countrys current median wages and salaries of just RM2062 per month for 2020.

KJ Says Cannabis Is Actually Legal In Malaysia And Everyone Loses Their Minds. It explains why the local role is essential for the recovery and. Your academic level paper type and format the number of pages and sources discipline and deadline.

Malaysias poverty line is a monthly income of RM2280. Where income is taxable in the source country and in the country of residence of the recipient of such income. Our custom writing service is a reliable solution on your academic journey that will always help you if your deadline is too tight.

The American Rescue Plan Act of 2021 also called the COVID-19 Stimulus Package or American Rescue Plan Pub L. KUALA LUMPUR Oct 5. Mobile Wage Reporting Application See SSI Mobile Wage Reporting Application See SSI Mobile Wage Reporting Application.

The upcoming Budget 2022 must focus on the survival issues of small and medium-sized enterprises SMEs said Small and Medium Enterprises Association SAMENTAIn its budget wishlist on Tuesday SAMENTA central chairman Datuk William Ng said the association has suggested that personal income tax for 2021 should be exempted for those with a. Raising the minimum wage to RM1600 per month. You fill in the order form with your basic requirements for a paper.

Medicare is funded partly by a 15 income tax levy with exceptions for low-income earners but mostly out of general revenue. Govt allocates RM2 billion to continue wage subsidy programme targeting 300000 workers. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Budget 2022 is also providing targeted wage subsidies for employers in the tourism industry who have seen their income reduced by at least 30. There is a means tested 30 subsidy on private health insurance. You wanna do high taxation like other countries then increase the minimum wage first lah so everyone got taxable income.

International double taxation arises when comparable taxes are imposed in two or more states on the same taxpayer in respect of the same taxable income or capital eg. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Modified Benefits Formula Questionare Form SSA-150 Cuestionario de fórmula modificada del beneficio Formulario SSA-150.

Under Canadas marginal tax rates for 2021 an individual with taxable income equal to 216511 would incur total federal tax before credits at an effective federal rate of approximately 2316 the effective rate would increase for higher taxable incomes as the top marginal rate of 33 would apply to additional income. The system is thus based on the taxpayers ability to pay. Get 247 customer support help when you place a homework help service order with us.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. He also proposed that sales and service tax be set at a flat rate of 4 to stimulate consumer demand and company tax cut to 15 for the first RM500000 of. In continuing the wage subsidy programme targeting 300000 workers the government has allocated a sum of RM2 billion.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. 603-7785 2624 603-7785 2625.

In addition to providing the basic tax implications for business operations in the United States we share our observations regarding the tax consequences for US operations of global businesses. It estimates that the share of jobs potentially at risk during confinement ranges from 15 to 35 across regions within 30 OECD and 4 non-OECD European countries. The first RM100 million in taxable earnings will be taxed at 24 while the remainder.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Income tax exemptions for winners of eligible e-sports championships. The minimum wage in Malaysia was last raised to RM1200 with effect from Feb 1 2020 for urban areas and RM1100 per month for rural areas.

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. For the first RM500000 of taxable income for 2021 and 2022. Level 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel.

Malaysias Budget 2022 is about bolstering economic recovery by building resilience and driving reform after the strict lockdown measures that were used to curb COVID-19. Govt allocates RM2 billion to continue wage subsidy programme targeting 300000 workers. Malaysia has unveiled a budget with a focus on business resilience social wellbeing and economic stability.

Modified Adjusted Gross Income MAGI modificación del ingreso bruto ajustado. Im not sure where you get the figure that only 10 of the population pays taxes however if its true it shows that the majority of Malaysians income is below the taxable bracket.

Covid 19 The Enhanced Wage Subsidy Programme Bdo

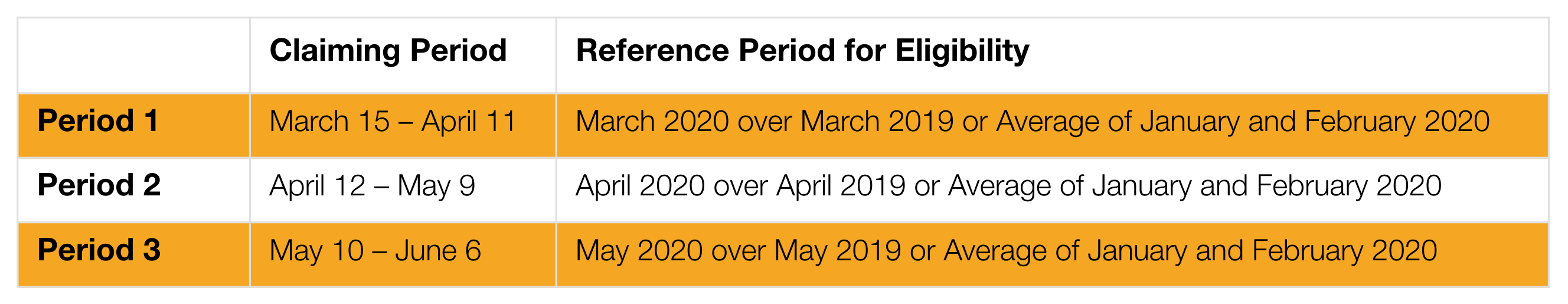

Covid 19 Canada Emergency Wage Subsidy Crowe Soberman Llp

Flash Alerts Covid 19 Kpmg Global

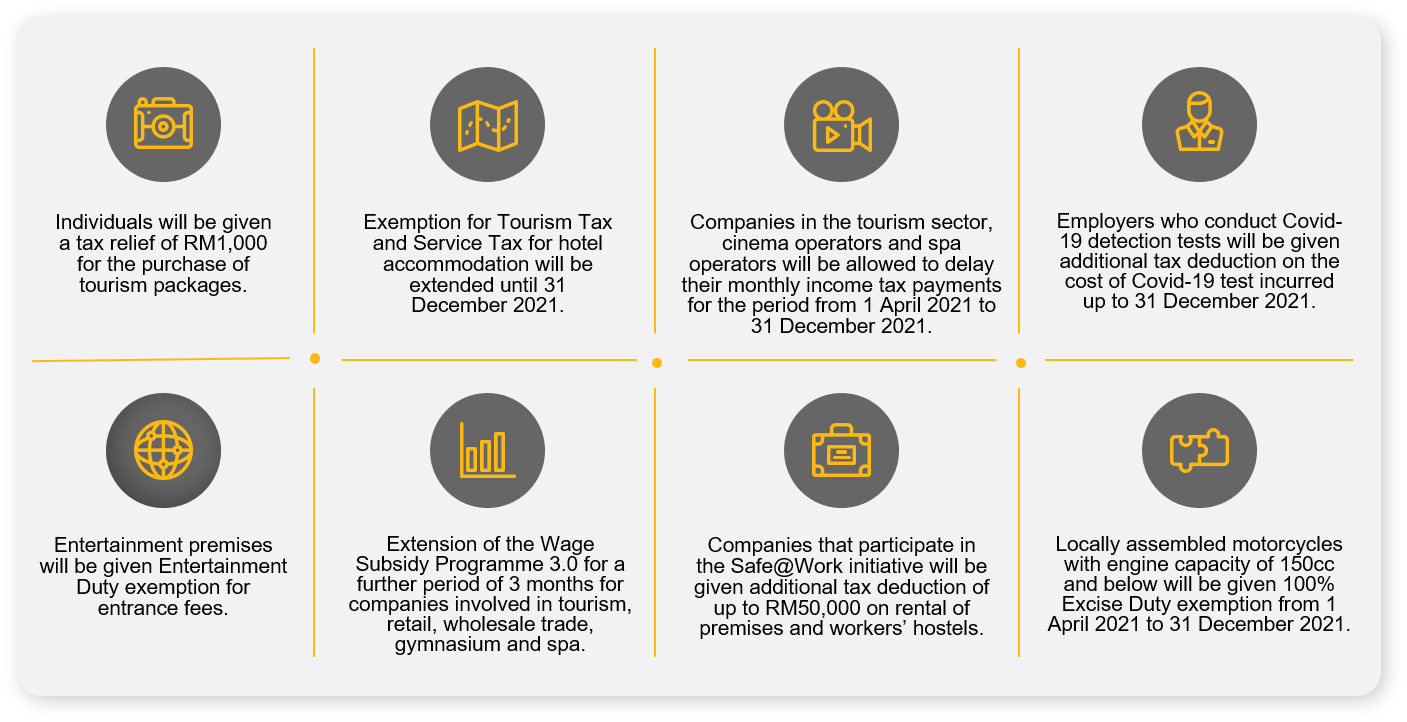

Permai Assistance Package Key Tax Measures Subsidies Crowe Malaysia Plt

Pemerkasa Assistance Package Crowe Malaysia Plt

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

Faq On The Wage Subsidy Programme Donovan Ho

Morocco 2020 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Morocco In Imf Staff Country Reports Volume 2021 Issue 002 2021

Covid 19 What Government Support Is Available For Businesses Tax Deloitte New Zealand

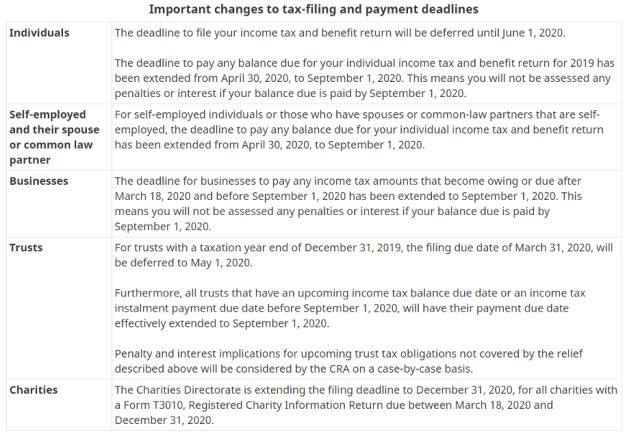

Canada Passes Covid 19 Economic Response Plan Into Law Our Tax Take Tax Canada

Iii Domestic Consumption And Production Taxes In Tax Policy Handbook

Social Spending For Inclusive Growth In The Middle East And Central Asia In Departmental Papers Volume 2020 Issue 012 2020

Post a Comment for "Is Wage Subsidy Taxable Income Malaysia"