Are Election Workers Exempt From Taxes

Services performed by election workers and election officials paid less than the calendar year threshold amount mandated by law. Unless Section 218 agreement covers election workers.

Doing Business In The United States Federal Tax Issues Pwc

The House of Representatives passes on final reading the bill which seeks to exempt from income tax the honoraria travel allowance and other benefits.

Are election workers exempt from taxes. Write Exempt in the space below Step 4 c Complete Steps 1 a 1 b and 5. For most wage earners there is no. Election workers are common-law employees.

To elect exemption Form 8274 must be filed before the first date on which a quarterly employment tax return would otherwise be due from the electing organization. To claim exemption employees must. The purpose of filing an exemption is for an officer of a corporation or member of a limited liability company to exclude themselves from the workers compensation laws.

Rules for Exempt Organizations During an Election Year Judith Kindell Senior Technical Advisor to the Director Exempt Organizations Justin Lowe Tax Law Specialist Exempt Organizations Material provided in this presentation is for educational use only and is not. The Florida Division of Workers Compensation Division is pleased to offer this online service that allows you to submit your Notice of Election to be Exempt. Services performed by a licensed guide under Title 12 section 7311 and excluded from the Federal Unemployment Tax Act FUTA are exempt from unemployment tax.

Poll Workers Special Ballot 2019 pdf Posted October 14 2020 W-4 Form 2021 pdf Posted June 17 2021 F410-002 Withholding Certification Affirmation 2021 pdf Posted June 17 2021 IT-2104 Employees Withholding Allowance Certificate 2021 pdf Posted June 17 2021 IT-2104-E Certificate of Exemption Withholding fill in form 2021 pdf. The employee is exempt from mandatory Medicare tax if the employee is a member of a qualifying public retirement system and all of the following requirements. 2 days agoKansas food sales tax is 2nd highest in US governor potential opponent support exemption.

Elect a qualifying company for tax exemption on UK capital. With this online system you can apply for or renew an exemption modify your application and print your Certificate. For legal reference 26 MRSA.

Upon issuance of a Certificate of Election to be Exempt the officer or member is not an employee and may not recover workers compensation benefits. Under Tax Data indicate YES to be Exempt from Social Security and Medicare. Service performed by direct sellers as defined in 26 US Code section 3508 b 2 are exempt from unemployment.

Coverage threshold definition A coverage threshold is an amount of earnings that triggers coverage under the Social Security program. KWCH - At 65 percent Kansas. MANILA - The House of Representatives has approved a proposal exempting election workers pay from income taxes.

From January 1 2020 forward the Federal Insurance Contributions Act FICA tax exclusion for election officials and election workers is 1900 a calendar year unless those wages are subject to Social Security and Medicare taxes under the States Section 218 Agreement. Entities that fall into one of the categories of organizations that qualify for an exemption must submit an application to Maine Revenue Services and provide the. Earnings below the threshold are not taxable under Social Security nor do such earnings count toward future benefits.

Elect an offshore collective investment vehicle for tax exemption on UK capital gains. Many state and local government employees are excluded from FICA taxes until their election wages reach the 1800 threshold at which point the income is subject to FICA tax. However all wages earned by the election worker are subject to income tax.

If the election workers are covered by a Section 218 Agreement with the Social Security Administration SSA the terms of the Agreement will determine whether the payments are subject to FICA. Election workers and election officials in these three States paid less than the threshold amount in a calendar year are excluded from FICA taxes due to the mandatory Social Security and Medicare provision which excludes from coverage those election workers and election officials who earn less than the threshold amount. Wages paid to an election worker are not subject to income tax withholding.

Enter at Business Income Expenses and TurboTax TT. House Bill 9652 exempts the honoraria travel allowance and such other benefits granted to persons rendering election service from the computation of individual tax income. The organization may make the election only if it is opposed for religious reasons to the payment of FICA taxes.

Domestic employees Election workers. It is best to contact your state Social Security Administrator with questions regarding Section 218 coverage as Social Security coverage varies greatly from state and even within local jurisdictions. If they are taxable t he IRS considers undocumented cash income no W-2 or 1099-MISC for work performed to be self employment income.

However IRC section 3121b7E and Fiv provide specific rules for determining whether amounts paid to election workers are subject to FICA taxes. Again employees must use Form W-4 to tell you they are tax exempt. If you see a W-4 with the word Exempt you know not to withhold federal income tax from that employees wages.

Firstly here is a link to determine if your election earnings are in fact tax exempt. THE COMMISSION on Elections Comelec said Thursday that teachers working as poll workers during the May 13 elections will be exempt from paying taxes if they qualify under a certain income category and file an affidavit attesting to their exempt status under the law. Typically all election workers will have 0 zero dependents and no additional withholding.

Teachers usually serve as Boards of Election Inspectors on voting day to manage the actual voting in. Click on their Tax ID from your Tax Tables then enter 99999 for no taxes to be taken and be sure each tax status is Active. Leave the rest of the W-4 blank.

The Sales and Use Tax Law provides specific exemptions for a number of different kinds of organizations and institutions such as hospitals schools churches and libraries etc.

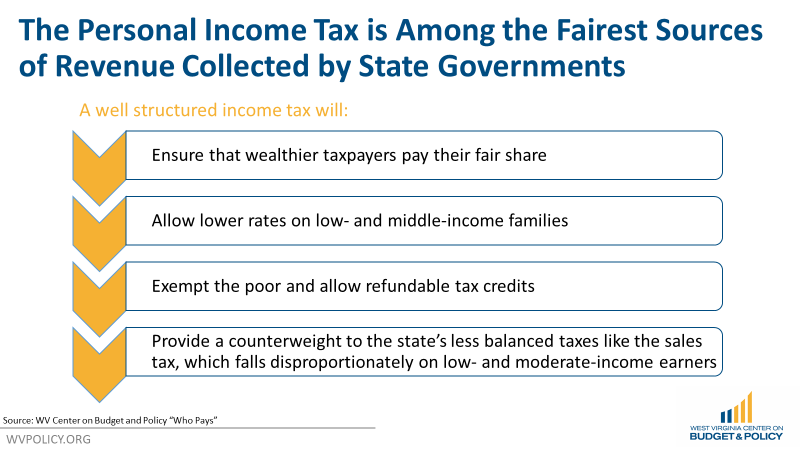

Eliminating The Personal Income Tax Ineffective Policy That Would Harm Working Wv Families West Virginia Center On Budget Policy

Tips For Traders Preparing 2020 Tax Returns Extensions And 475 Elections

Tax Implications Of A Democratic Sweep In November S Election Novogradac

Labor S Role In Abolishing The Poll Tax Special Collections University Archives

Elections Mining Taxes And Civil Liability Everything That Passed In The Legislature S Special Session The Nevada Independent

State W 4 Form Detailed Withholding Forms By State Chart

Election Workers Can Receive Tax Breaks On Their Income The Peck Group Lc

For Election Day A History Of The Poll Tax In America

State W 4 Form Detailed Withholding Forms By State Chart

Election Workers Can Receive Tax Breaks On Their Income The Peck Group Lc

Teachers Group Hopeful For Passage Of Bill Exempting Poll Workers Pay From Tax Philstar Com

Tac Are Election Workers County Employees

Post a Comment for "Are Election Workers Exempt From Taxes"